You are considering buying a car from a local auto dealer. The dealer offers you one of

Question:

You are considering buying a car from a local auto dealer. The dealer offers you one of two payment options:

? You can pay $30,000 cash.

? The ?deferred payment plan?: You can pay the dealer $5,000 cash today and a payment of $1,050 at the end of each of the next 30 months.?

As an alternative to the dealer fi nancing, you have approached a local bank, which is willing to give you a car loan of $25,000 at the rate of 1.25% per month.

a. Assuming that 1.25% is the opportunity cost, calculate the present value of all the payments on the dealer?s deferred payment plan.

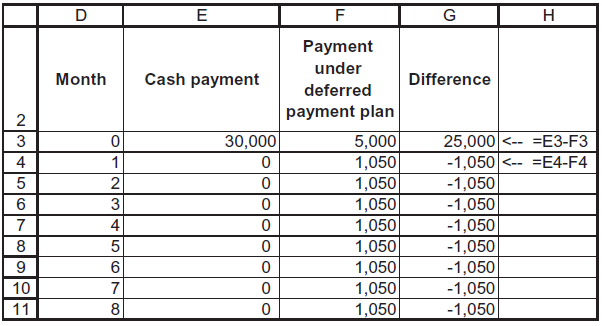

b. What is the effective interest rate being charged by the dealer? Do this calculation by preparing a spreadsheet like this (only part of the spreadsheet is shown?you have to do this calculation for all 30 months):

Now calculate the IRR of the difference column; this is the monthly effective interest rate on the deferred payment plan.

DealerA dealer in the securities market is an individual or firm who stands ready and willing to buy a security for its own account (at its bid price) or sell from its own account (at its ask price). A dealer seeks to profit from the spread between the...

Step by Step Answer: