Craig Incorporated (a fictional company) manufactures and sells security systems. Selected information from the companys 20X3 financial

Question:

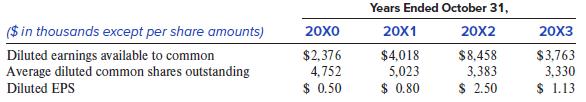

Craig Incorporated (a fictional company) manufactures and sells security systems. Selected information from the company’s 20X3 financial statements show:

On December 31, 20X1, Craig Incorporated bought back 1,237,000 shares of common stock for $11,750,000.

Required:

1. What would diluted EPS have been in 20X2 and 20X3 had the company not repurchased its common shares? Note that the company has an October 31 fiscal year-end.

2. Compare the company’s profit performance in 20X3 to earlier years, and comment on this comparison.

3. The stock buyback isn’t the only reason that average diluted common shares declined from 20X1 to 20X2. What else do you think could have contributed to this decline in average diluted common shares?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer