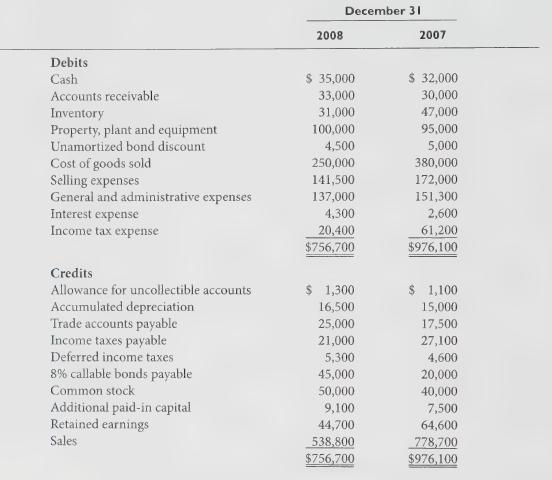

Question: Flax Corporation uses the direct method to prepare its statement of cash flows. Flax's trial bal- ances at December 31, 2008 and 2007 follow: Additional

Flax Corporation uses the direct method to prepare its statement of cash flows. Flax's trial bal- ances at December 31, 2008 and 2007 follow:

Additional Information:

• Flax purchased $5,000 in equipment during 2008.

• Flax allocated one-third of its depreciation expense to selling expenses and the remainder to general and administrative expenses.

Show your work for all answers to the following questions:

Required:

What amount should Flax report in its statement of cash flows for the year ended December 31, 2008 for the following:

1. Cash collected from customers?

2. Cash paid for goods sold?

3. Cash paid for interest?

4. Cash paid for income taxes?

5 . Cash paid for selling expenses?

2008 December 31 2007 Debits Cash Accounts receivable Inventory Property, plant and equipment Unamortized bond discount Cost of goods sold $ 35,000 33,000 $ 32,000 30,000 31,000 47,000 100,000 95,000 4,500 5,000 250,000 380,000 Selling expenses 141,500 172,000 General and administrative expenses 137,000 151,300 Interest expense 4,300 2,600 Income tax expense 20,400 61,200 $756,700 $976,100 Credits Allowance for uncollectible accounts $ 1,300 $ 1,100 Accumulated depreciation 16,500 15,000 Trade accounts payable 25,000 17,500 Income taxes payable 21,000 27,100 Deferred income taxes 5,300 4,600 8% callable bonds payable 45,000 20,000 Common stock 50,000 40,000 Additional paid-in capital 9,100 7,500 Retained earnings 44,700 64,600 Sales 538,800 778,700 $756,700 $976,100

Step by Step Solution

3.34 Rating (169 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts