Neighborhood Supermarkets is preparing to go public, and you are asked to assist the firm by preparing

Question:

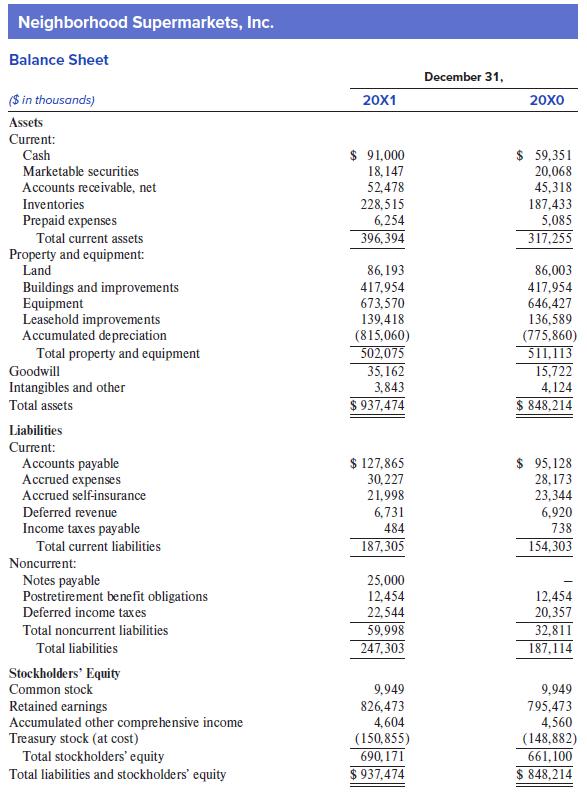

Neighborhood Supermarkets is preparing to go public, and you are asked to assist the firm by preparing its statement of cash flows for 20X1. Neighborhood’s balance sheets at December 31, 20X0, and December 31, 20X1, and its income statement for the year ending December 31, 20X1, appear below.

Neighborhood Supermarkets, Inc. | |

Income Statement for the Year Ended December 31, 20X1 | |

($ in thousands) | |

Net sales | $ 2,516,364 |

Cost of sales | 1,837,657 |

Gross profit | 678,707 |

Depreciation expense | (47,201) |

Amortization expense | (6,207) |

Self-insurance expenses | (43,000) |

Loss on sale of equipment | (60) |

Operating, general, and administrative expenses | (486,665) |

Income from operations | 95,574 |

Gain on sale of marketable securities | 208 |

Investment income | 1,556 |

Income before provision for income taxes | 97,338 |

Provision for income taxes | (24,335) |

Net income | $ 73,003 |

Additional Information:

a. The only entries in retained earnings for 20X1 were for net income and cash dividends.

b. During 20X1, bad debt expenses of $906 were included in operating, general, and administrative expenses; no accounts were written off.

c. Adjusting marketable securities upward by $68 led to the increase of $44 in accumulated other comprehensive income, after considering the deferred tax effect of $24.

d. On July 1, 20X1, Neighborhood Supermarkets bought land ($190) and equipment ($20,000), paying $10,190 in cash and issuing a $10,000 five-year note payable with interest at 6% payable annually. Accrued interest on the note was included in operating, general, and administrative expenses because the amount was deemed too immaterial to report separately.

e. No treasury stock was reissued during 20X1.

f. Equipment costing $9,052 with a book value of $1,051 was sold for cash.

g. A much smaller competitor was acquired on December 31, 20X1, for $34,890 cash and a 7%, $15,000 note that matures in two years. Neighborhood allocated the acquisition cost as follows: inventory, $5,500; intangibles, $5,926; equipment, $16,195; leasehold improvements, $2,829; goodwill, $19,440.

Required:

Use the indirect method to prepare Neighborhood Supermarkets’ statement of cash flows for 20X1. Use the worksheet approach from the Chapter 4 appendix.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer