On January 5, 20X1, Alpha Inc. acquired 80% of the outstanding voting shares of Beta Inc. for

Question:

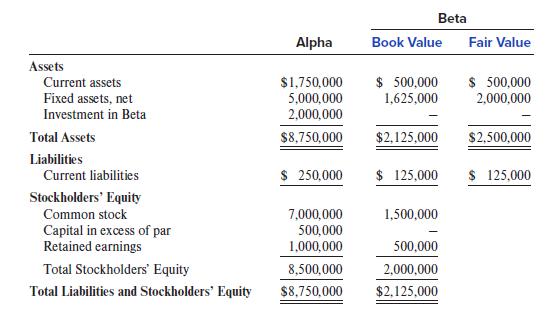

On January 5, 20X1, Alpha Inc. acquired 80% of the outstanding voting shares of Beta Inc. for $2,000,000 cash. Following are the separate balance sheets for the two companies immediately after the stock purchase, as well as fair value information regarding Beta Inc.:

Required:

1. Prepare the entries for adjustments and eliminations required to prepare the consolidated balance sheet immediately after acquisition under the acquisition method.

2. Prepare the consolidated balance sheet immediately after acquisition.

Beta Alpha Book Value Fair Value Assets $ 500,000 $ 500,000 Current assets Fixed assets, net $1,750,000 5,000,000 2,000,000 1,625,000 2,000,000 Investment in Beta Total Assets $8,750,000 $2,125,000 $2,500,000 Liabilities Current liabilities $ 250,000 $ 125,000 $ 125,000 Stockholders' Equity Common stock 7,000,000 1,500,000 Capital in excess of par Retained earnings 500,000 1,000,000 500,000 Total Stockholders' Equity 8,500,000 2,000,000 Total Liabilities and Stockholders' Equity $8,750,000 $2,125,000

Step by Step Answer:

Requirement 1 The elimination entries that Alpha should make in its consolidating worksheet are given below The identifying letter for each entry matc...View the full answer

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

Related Video

This video is about ways to attempt consolidated balance sheet questions. since the unconsolidated financial statements of parent and subsidiary companies are prepared separately, consolidating the balance sheets of both companies is critical and sometimes becomes complex. the tutorial will guide students on to how questions on attempting questions on consolidated financial statements in an easier yet more effective way.

Students also viewed these Business questions

-

On January 5, 2018, Alpha Inc. acquired 80% of the outstanding voting shares of Beta Inc. for $2,000,000 cash. Following are the separate balance sheets for the two companies immediately after the...

-

On January 5, 2015, Alpha Inc. acquired 80% of the outstanding voting shares of Beta Inc. for $2,000,000 cash. Following are the separate balance sheets for the two companies immediately after the...

-

On January 1, 2014, Delta Inc. acquired 80% of Sigma Companys outstanding stock for $80,000 cash. Following are the balance sheets for Delta and Sigma immediately before the acquisition, as well as...

-

In a small university, the Computer Science Department has six faculty members. However, each faculty member belongs to only the computer science department. This type of relationship is called a....

-

The role of the cell phone in modern life was investigated by a Pew Internet & American Life Project (April 2006) survey. A total of 1,286 cell phone users were interviewed in the sample. One of the...

-

In Exercise 1.1, you were asked to obtain the most recent annual report of a company that you were interested in reviewing throughout this term. Required: Liquidity: a. Calculate working capital, the...

-

Independent Nursing Consultants (INC) has the following data: If INC could streamline operations, cut operating costs, and raise net income to $\$ 300$, without affecting sales or the balance sheet...

-

Data for Zumbrunn Company are presented in P13-5A. In P13-5A, Zumbrunn Companys income statement contained the condensed information below. Zumbrunns balance sheet contained the comparative data at...

-

The December 3 1 , 2 0 2 4 , unadjusted account balances for Demon Deacons Corporation are presented below. Accounts Balance Cash $ 9 , 9 0 0 Accounts Receivable 1 4 , 9 0 0 Prepaid Rent 7 , 0 8 0...

-

Express the molecular mass ( uncertainty) of C9H9O6N3 with the correct number of significant figures.

-

Figa Company acquired a bond issued by Stewart Company on January 1, 20X1. The $100,000 bond had a coupon rate of 4%, with payments made semiannually. The bond was scheduled to mature on December 31,...

-

Figa Company acquired a bond issued by Stewart Company on January 1, 20X1. The $100,000 bond had a coupon rate of 4%, with payments made semiannually. The bond was scheduled to mature on December 31,...

-

The 18-electron rule is a general, but not universal, guide for assessing whether a certain transition-metal complex is stable or not. Both of the following are stable compounds, but only one obeys...

-

Metis Inc.'s Purchasing Department has incurred an expense of $279,200 for the year ended December 31, 20Y9. If the Purchasing Department receives 60,000 purchase requisitions throughout the year,...

-

Alin Co. purchases a building for $300,000 and pays an additional $30,000 for title fees and lawyer fees. Alin also pays $20,000 in renovations, including painting, carpet, lighting, etc.At what...

-

Bindi's Bridal has provided the following yearly financial results: Gross Sales: $162,750 Net Sales: $128,550 Opening Inventory: $85,950 Advertising Expenses: $8,200 Sales Salaries: $15,700 Rent:...

-

An incident light ray strikes a mirror with an angle of 58 to the surface of the mirror. What is the angle of reflection of the reflected ray? 0,=

-

What minimum number of 60 W lightbulbs must be connected in parallel to a single 180 V household circuit to trip a 36.0 A circuit breaker? lightbulbs Need Help? Read It Submit Answer

-

Sparr Investments Inc specializes in taxdeferred investment opportunities Sparr Investments, Inc.specializes in tax-deferred investment opportunities for its clients. Recently Spar offered a payroll...

-

Answer the following two independent questions. a. MM Corporation is considering several proposed investments for the coming budget year. MM produces electrical apparatus for industrial complexes....

-

Speculate on why accounting standards do not mandate full financial statements in interim reports.

-

Because of assumptions and estimates that go into the preparation of financial statements, the statements are inaccurate and are, therefore, not a very meaningful tool to determine the profits or...

-

Listed on the following page are phrases with the appropriate acronym. Match the letter that goes with each definition. a. Generally accepted accounting principles ( GAAP ) b. Securities and Exchange...

-

How does the concept of intersectionality, as developed by Kimberl Crenshaw, challenge traditional understandings of identity and social categorization by highlighting the interconnectedness and...

-

To what extent does intersectional scholarship inform policy-making and advocacy efforts aimed at addressing social disparities and promoting equity and justice for marginalized communities ?

-

How can intersectionality contribute to building solidarity and fostering coalitions across diverse social movements, while also recognizing and respecting the distinctiveness of different...

Study smarter with the SolutionInn App