Rumours, Inc. issued $10 million, 10% coupon bonds on January 1, 20X1, due on December 31, 20X5.

Question:

Rumours, Inc. issued $10 million, 10% coupon bonds on January 1, 20X1, due on December 31, 20X5. The prevailing market interest rate on January 1, 20X1, was 12%, and the bonds pay interest on June 30 and December 31 of each year.

On January 1, 20X2, Rumours issued $10 million, 10% coupon bonds due on December 31, 20X6. The prevailing market interest rate on January 1, 20X2, was 8%, and the bonds pay interest on June 30 and December 31 of each year.

Required:

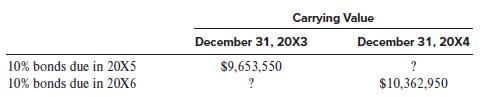

1. See the following (incomplete) table for each bond’s carrying value. Calculate the missing values.

2. How much interest expense did Rumours record in 20X4 on the bonds due in 20X5?

3. How much interest expense did Rumours record in 20X4 on the bonds due in 20X6?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer