The following information related to Exxon Mobils inventories is taken from its 2017 annual report. 3. Miscellaneous

Question:

The following information related to Exxon Mobil’s inventories is taken from its 2017 annual report.

3. Miscellaneous Financial Information In 2017, 2016, and 2015, net income included losses of $10 million, $295 million, and $186 million, respectively, attributable to the combined effects of LIFO inventory accumulations and drawdowns. The aggregate replacement cost of inventories was estimated to exceed their LIFO carrying values by $10.8 billion and $8.1 billion at December 31, 2017 and 2016, respectively.

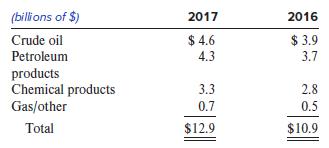

Crude oil, products, and merchandise as of year-end 2017 and 2016 consist of the following:

Required:

1. By how much would net income for 2017 have differed had Exxon Mobil used FIFO to value those inventory items valued under LIFO? Assume a 35% marginal tax rate. Be sure to indicate whether FIFO income would be higher or lower than LIFO income.

2. What would the LIFO reserve have been on December 31, 2017, if no drawdowns had occurred in 2017? The drawdowns represent LIFO liquidations.

3. What was the net difference in 2017 income taxes that Exxon Mobil experienced as a result of using LIFO rather than FIFO? Assume a 35% tax rate and indicate whether FIFO or LIFO would yield the higher tax and by how much.

4. What was the approximate rate of change in input costs in 2017 for Exxon Mobil’s inventory?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer