The Shareholders Equity section in the balance sheet of Holiday Roads Company (a fictional company) appears as

Question:

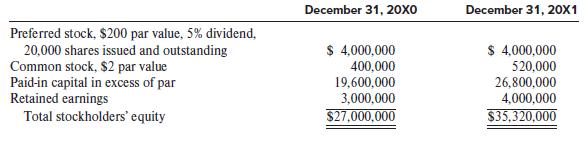

The Shareholders’ Equity section in the balance sheet of Holiday Roads Company (a fictional company) appears as follows:

Net income for 20X1 was $1,700,000, preferred stock dividends were $200,000, and common stock dividends were $500,000. The company issued 60,000 shares of common stock on July 1, 20X1.

Required:

1. What is the company’s basic EPS for 20X1?

2. Suppose that Holiday Roads also had $500,000 of 10% convertible subordinated debentures outstanding at the beginning and end of 20X1. Each $1,000 bond is convertible into 100 shares of common stock, cash settlement is not permitted, and the company’s income tax rate is 21%. What is the company’s diluted EPS for 20X1?

3. What other types of securities in addition to convertible debt can affect the calculation of diluted EPS?

4. During 20W7, Holiday Roads Company granted incentive stock options to employees that allowed them to buy 50,000 shares of common stock at an exercise price of $10 per share, which was also the market price per share on the grant date. The options were exercisable on January 1, 20X0. The average market price per share of the company’s shares in 20X1 was $25. Building on requirement 2, what would be the company’s diluted EPS for 20X1 in light of both the convertible subordinated debentures and the employee stock options?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer