Germany-based Adidas is one of the worlds largest producers of sportswear. On March 15, 2018, one day

Question:

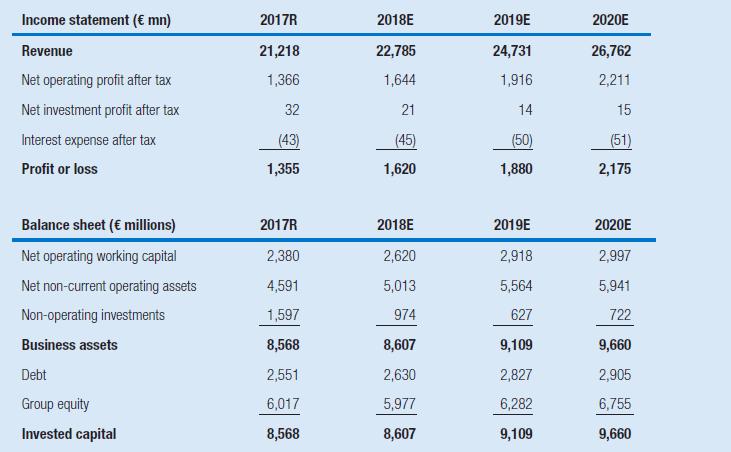

Germany-based Adidas is one of the world’s largest producers of sportswear. On March 15, 2018, one day after the publication of Adidas’s 2017 financial statements, an analyst produces a set of near-term forecasts of Adidas’s 2018–2020 performance and financial position.

On the day that the analyst issues her forecasts, Adidas’s closing share price equals €193. The analyst assumes that Adidas’s long-term tax rate equals 30 percent, the company’s diluted number of shares outstanding is 204 million, and the company’s required return on operating assets and cost of equity are both 9 percent. The analyst estimates that the fair value of Adidas’s net operating assets equals €31,554 million.

1 Check whether all changes in the book value of equity that the analyst predicts can be fully explained through profits and dividends. Why is this an important property of the analyst’s equity estimates?

2 Based on a market value of €39,372 million on March 15, 2018, and the analyst’s estimates, Adidas’s leading market value-to-earnings ratio is 24.3. What does this ratio suggest about the analyst’s expectations about future abnormal profit growth?

3 Calculate abnormal NOPAT and free cash flow from operations for the years 2018–2020. Note that free cash flow from operations is defined as:

NOPAT – Change in net operating assets.

4 Assume that abnormal NOPAT in 2021 and beyond is zero. Estimate the value of Adidas’s net operating assets (NOA) at the end of 2017.

What might explain the difference between your NOA value estimate and the analyst’s estimate (of €31,554 million)?

5 Calculate the present value of the free cash flow from operations for the years 2018–2020 and compare this present value to your NOA estimate calculated under item 4.

What explains the difference between these two amounts? Why is this difference equal to the present value of Adidas’s net operating assets at the end of 2020?

Step by Step Answer:

Business Analysis And Valuation

ISBN: 978-1473758421

5th Edition

Authors: Erik Peek, Paul Healy, Krishna Palepu