Hugo Boss AG is a German designer, manufacturer, and distributer of mens and womens clothing, operating in

Question:

Hugo Boss AG is a German designer, manufacturer, and distributer of men’s and women’s clothing, operating in the higher end of the clothing retail industry.

During the period 2004–2017, the company consistently earned returns on equity in excess of 20 percent, with peaks around 50 to 60 percent, grew its book value of equity (before special dividends) by 5 percent per year, on average, and paid out 65–80 percent of its profit as dividends.

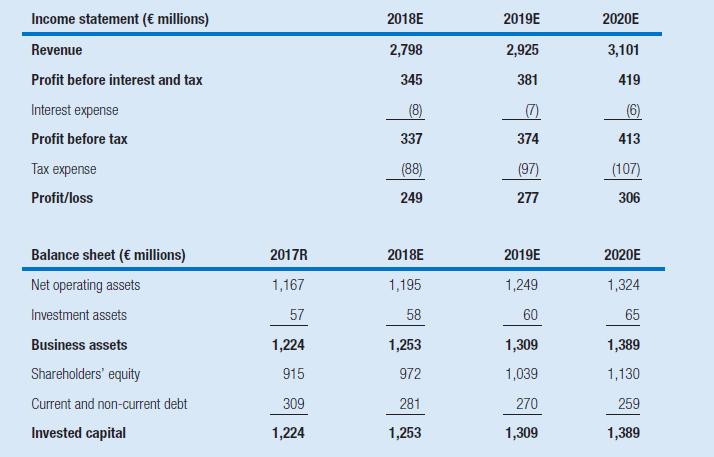

On March 29, 2018, before the publication of the first-quarter results, when Hugo Boss’s 69.0 million common shares trade at about €71 per share, an analyst produces the following forecasts for Hugo Boss.

Assume that Hugo Boss’s cost of equity equals 10 percent.

1 Calculate free cash flows to equity, abnormal profits, and abnormal profit growth for the years 2018–2020.

2 Assume that in 2021 Hugo Boss AG liquidates all its assets at their book values, uses the proceeds to pay off debt, and pays out the remainder to its equity holders. What does this assumption imply about the company’s:

a. Free cash flow to equity holders in 2021 and beyond?

b. Abnormal profits in 2021 and beyond?

c. Abnormal profit growth in 2021 and beyond?

3 Estimate the value of Hugo Boss’s equity on March 29, 2018, using the preceding forecasts and assumptions. Check that the discounted cash flow model, the abnormal profit model, and the abnormal profit growth model yield the same outcome.

4 The analyst estimates a target price of €77 per share. What is the expected value of Hugo Boss’s equity at the end of 2020 that is implicit in the analysts’ forecasts and target price?

5 Under the assumption that the historical trends in the company’s ROE (i.e., approximately 25 percent), payout ratio (80 percent), and book equity growth (5 percent) continue in the future, what would be your estimate of Hugo Boss’s equity value-to-book ratio?

Step by Step Answer:

Business Analysis And Valuation

ISBN: 978-1473758421

5th Edition

Authors: Erik Peek, Paul Healy, Krishna Palepu