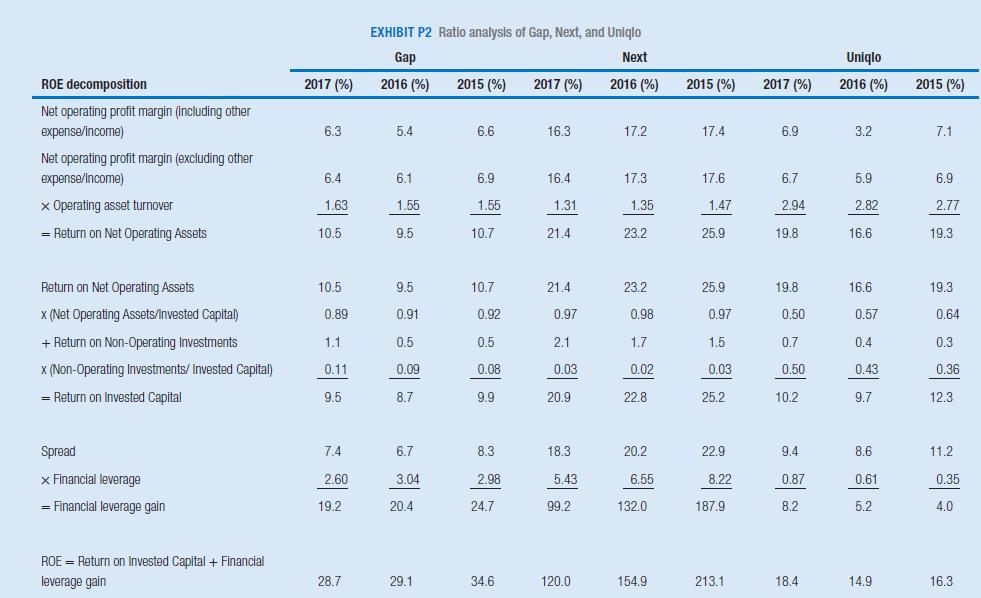

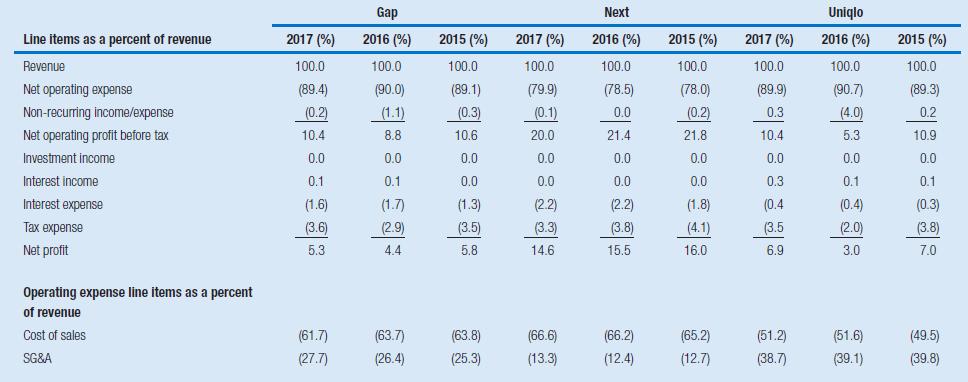

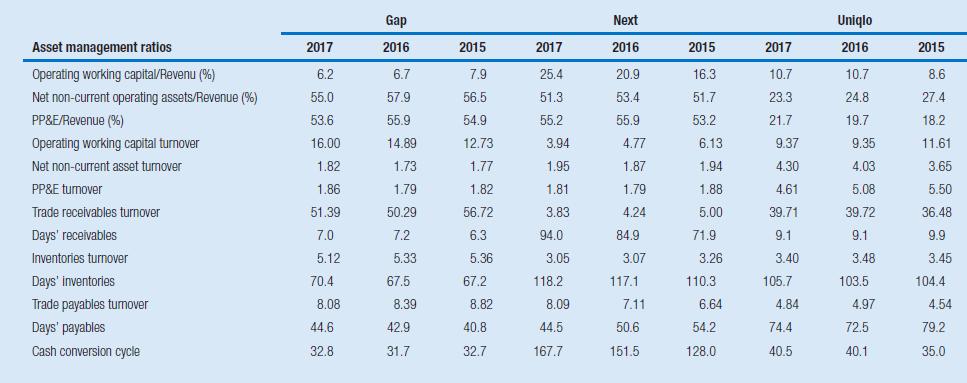

Exhibit P2 displays a selected set of financial ratios for the years 20152017 of three fashion retailers:

Question:

Exhibit P2 displays a selected set of financial ratios for the years 2015–2017 of three fashion retailers: USbased Gap, UK-based Next, and Japan-based Uniqlo (Fast Retailing). Using this set of ratios, analyze the retailers’ financial performance.

1 The return on equity (ROE) decomposition shows that the underlying drivers of ROE performance vary across retailers. Which economic or strategic factors may explain these differences in the components of ROE?

2 How did performance trends (during the period 2015 to 2017) differ among the three retailers?

Which factors contributed most to these differences?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Business Analysis And Valuation

ISBN: 978-1473758421

5th Edition

Authors: Erik Peek, Paul Healy, Krishna Palepu

Question Posted: