In response to the boards first question, Templeton would most likely reply that such a change would

Question:

In response to the board’s first question, Templeton would most likely reply that such a change would be justified if:

A. the inflation rate in the United States became hyperinflationary.

B. management wanted to flow more of the gains through net income.

C. Consol-Can were making autonomous decisions about operations, investing, and financing.

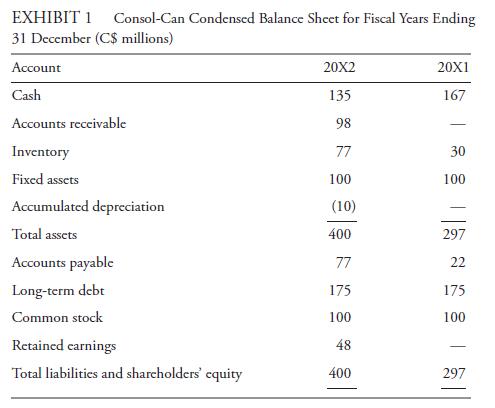

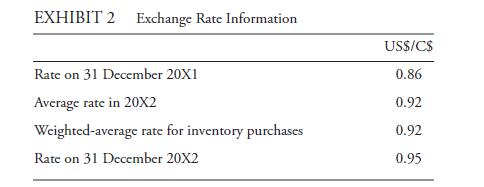

Consolidated Motors is a US-based corporation that sells mechanical engines and components used by electric utilities. Its Canadian subsidiary, Consol-Can, operates solely in Canada. It was created on 31 December 20X1, and Consolidated Motors determined at that time that it should use the US dollar as its functional currency. Chief Financial Officer Monica Templeton was asked to explain to the board of directors how exchange rates affect the financial statements of both Consol-Can and the consolidated financial statements of Consolidated Motors. For the presentation, Templeton collects Consol-Can’s balance sheets for the years ended 20X1 and 20X2 (Exhibit 1), as well as relevant exchange rate information (Exhibit 2).

Templeton explains that Consol-Can uses the FIFO inventory accounting method and that purchases of C$300 million and the sell-through of that inventory occurred evenly throughout 20X2. Her presentation includes reporting the translated amounts in US dollars for each item, as well as associated translation-related gains and losses. The board responds with several questions.

• Would there be a reason to change the functional currency to the Canadian dollar?

• Would there be any translation effects for Consolidated Motors if the functional currency for Consol-Can were changed to the Canadian dollar?

• Would a change in the functional currency have any impact on financial statement ratios for the parent company?

• What would be the balance sheet exposure to translation effects if the functional currency were changed?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie