Yahoo! Inc. is a US-based digital media company that reports in US dollars and prepares financial statements

Question:

Yahoo! Inc. is a US-based digital media company that reports in US dollars and prepares financial statements in accordance with US GAAP.

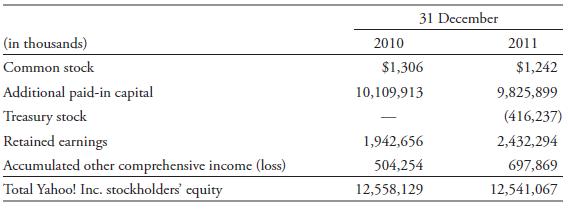

The stockholders’ equity section of Yahoo!’s consolidated balance sheets includes the following line items:

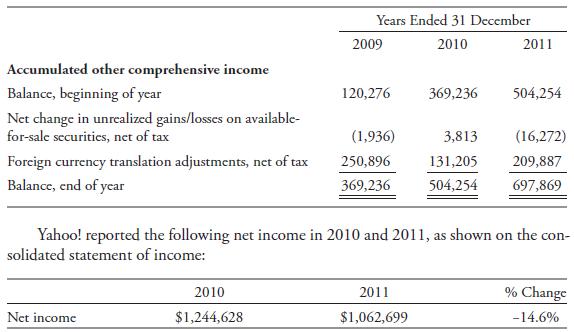

The consolidated statement of stockholders’ equity provides detail on the components comprising “Accumulated other comprehensive income.” The relevant portion of that statement appears below:

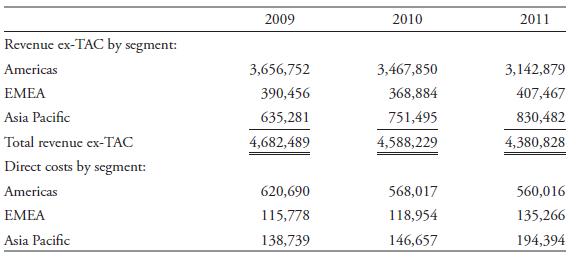

Yahoo!’s disclosures for its three geographic segments are disclosed in a note to the financial statements. Revenue (excluding total acquisition costs) and direct segment operating costs are shown below:Yahoo!’s disclosures for its three geographic segments are disclosed in a note to the financial statements. Revenue (excluding total acquisition costs) and direct segment operating costs are shown below:

In the MD&A section of the 2011 annual report, Yahoo! describes the source of its translation exposure:

Translation Exposure

We are also exposed to foreign exchange rate fluctuations as we convert the financial statements of our foreign subsidiaries and our investments in equity interests into US dollars in consolidation. If there is a change in foreign currency exchange rates, the conversion of the foreign subsidiaries’ financial statements into US dollars results in a gain or loss which is recorded as a component of accumulated other comprehensive income which is part of stockholders’ equity.

Revenue ex-TAC (total acquisition costs) and related expenses generated from our international subsidiaries are generally denominated in the currencies of the local countries. Primary currencies include Australian dollars, British pounds, Euros, Japanese Yen, Korean won, and Taiwan dollars. The statements of income of our international operations are translated into US dollars at exchange rates indicative of market rates during each applicable period. To the extent the US dollar strengthens against foreign currencies, the translation of these foreign currency-denominated transactions results in reduced consolidated revenue and operating expenses. Conversely, our consolidated revenue and operating expenses will increase if the US dollar weakens against foreign currencies. Using the foreign currency exchange rates from the year ended December 31, 2010, revenue ex-TAC for the Americas segment for the year ended December 31, 2011 would have been lower than we reported by $6 million, revenue ex-TAC for the EMEA segment would have been lower than we reported by $16 million, and revenue ex-TAC for the Asia Pacific segment would have been lower than we reported by $59 million.

Using the foreign currency exchange rates from the year ended December 31, 2010, direct costs for the Americas segment for the year ended December 31, 2011 would have been lower than we reported by $2 million, direct costs for the EMEA segment would have been lower than we reported by $5 million, and direct costs for the Asia Pacific segment would have been lower than we reported by $15 million.

Using the information above, address the following questions:

1. By how much did accumulated other comprehensive income change during the year ended 31 December 2011? Where can this information be found?

2. How much foreign currency translation adjustment was included in other comprehensive income for the year ended 31 December 2011? How does such an adjustment arise?

3. If foreign currency translation adjustment had been included in net income (rather than in other comprehensive income), how would the 2010/2011 change in income have been affected?

4. From what perspective does Yahoo! describe its foreign currency risk?

5. What percentage of total revenue ex-TAC was generated by the Asia-Pacific segment for the year ended 31 December 2011? What would this percentage have been if there had been no change in foreign currency exchange rates during the year?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie