Use the following excerpts taken from Royal Dutch Shell (LSE: RDSA) 2008 consolidated financial statements and notes

Question:

Use the following excerpts taken from Royal Dutch Shell (LSE: RDSA) 2008 consolidated financial statements and notes to the consolidated financial statements to answer the questions below.

Use the above information to answer the following questions:

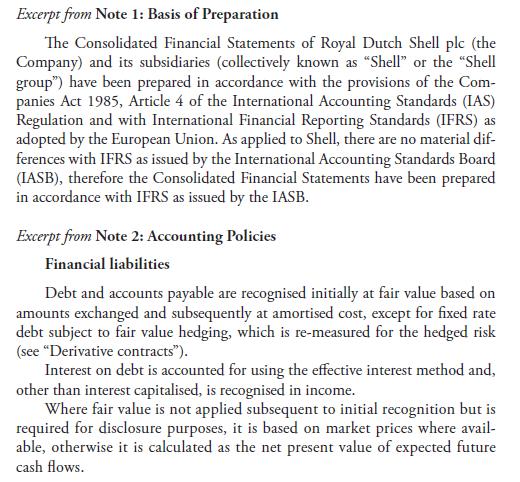

1. How does Royal Dutch Shell initially value its debt on the balance sheet? How is debt subsequently measured on the balance sheet?

2. What method does Shell use to calculate interest expense on its debt?

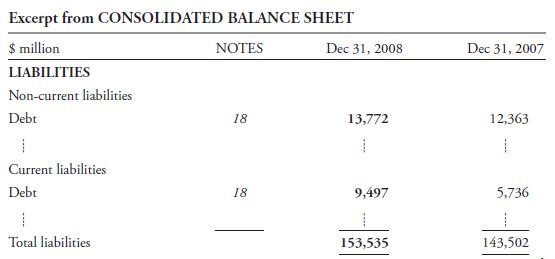

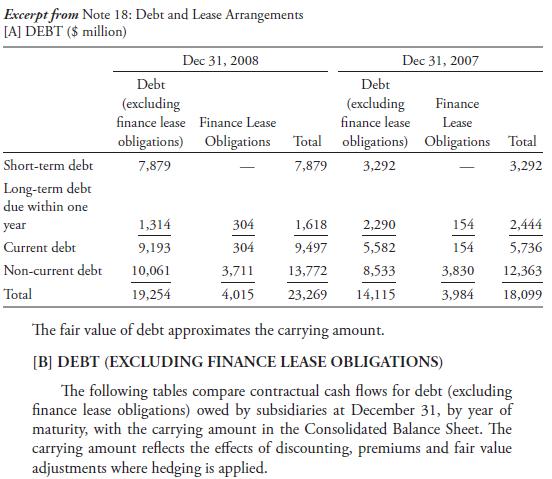

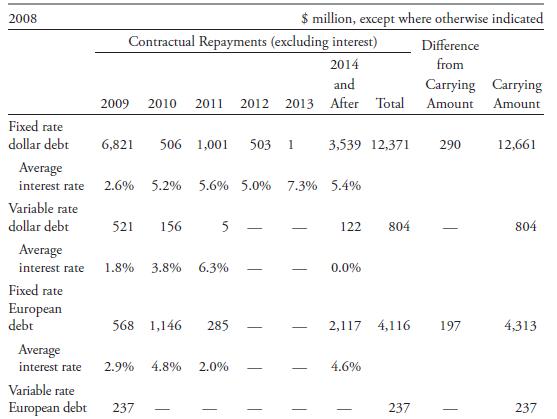

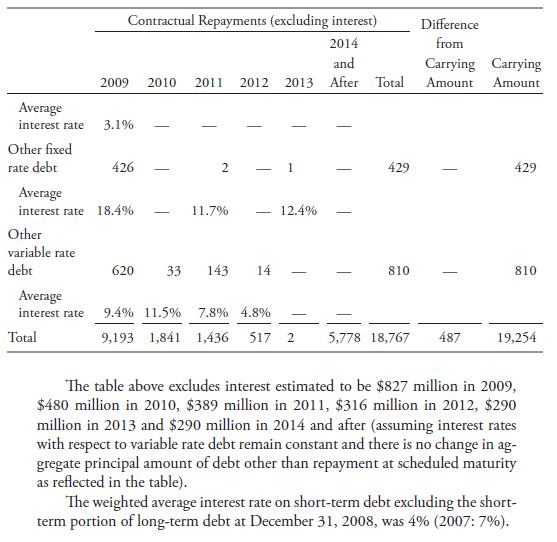

3. What is the total amount of debt appearing within current liabilities on the balance sheet at 31 December 2008, and what does it include?

4. What is the total amount of debt due after one year appearing on the balance sheet at 31 December 2008, and what does it include?

5. How does the interest rate in 2008 on short-term debt (excluding finance lease obligations and the short-term portion of long-term debt) compare to that in 2007?

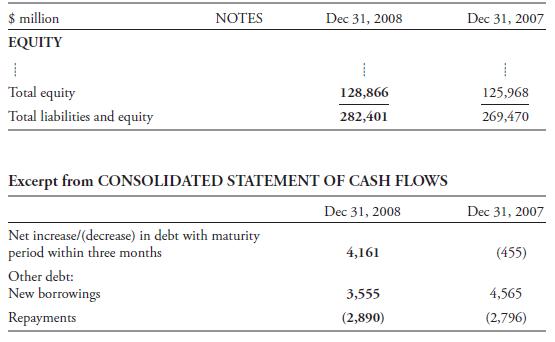

6. What is the fair value of Royal Dutch Shell’s debt at 31 December 2008?

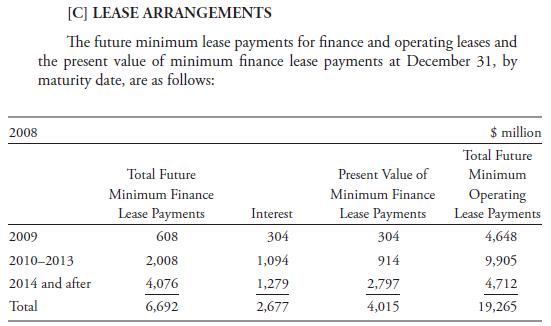

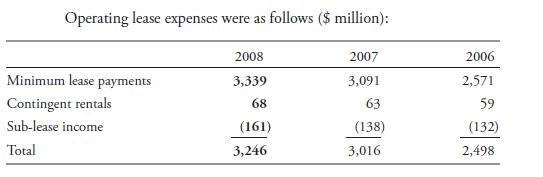

7. What was Royal Dutch Shell’s rent expense in fiscal year 2008 related to operating leases?

8. Comment on the relative magnitude of operating leases compared to finance leases.

9. What are Shell’s debt-to-equity ratios for 2008 and 2007? Comment on year-to-year changes.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie