You are analyzing three hypothetical companies: EVEN-LI Co., SOONER Inc., and AZUSED Co. At the beginning of

Question:

You are analyzing three hypothetical companies: EVEN-LI Co., SOONER Inc., and AZUSED Co. At the beginning of Year 1, each company buys an identical piece of box manufacturing equipment for $2,300 and has the same assumptions about useful life, estimated residual value, and productive capacity. The annual production of each company is the same, but each company uses a different method of depreciation. As disclosed in each company’s notes to the financial statements, each company’s depreciation method, assumptions, and production are as follows:

Depreciation method

• EVEN-LI Co.: straight-line method

• SOONER Inc.: double-declining balance method (the rate applied to the carrying amount is double the depreciation rate for the straight-line method)

• AZUSED Co.: units-of-production method Assumptions and production

• Estimated residual value: $100

• Estimated useful life: 4 years

• Total estimated productive capacity: 800 boxes

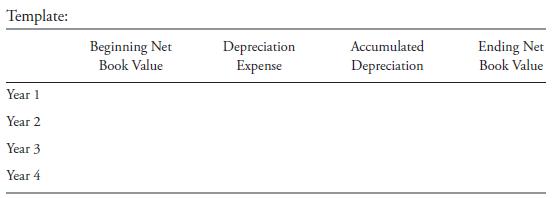

• Production in each of the four years: 200 boxes in the first year, 300 in the second year, 200 in the third year, and 100 in the fourth year 1. Using the following template for each company, record its beginning and ending net book value (carrying amount), end-of-year accumulated depreciation, and annual depreciation expense for the box manufacturing equipment.

2. Explain the significant differences in the timing of the recognition of the depreciation expense.

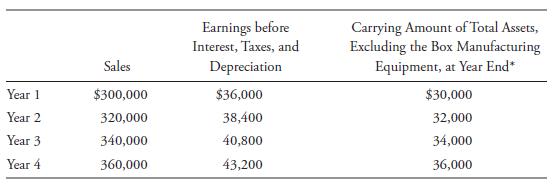

3. For each company, assume that sales, earnings before interest, taxes, and depreciation, and assets other than the box manufacturing equipment are as shown in the following table. Calculate the total asset turnover ratio, the operating profit margin, and the operating return on assets for each company for each of the four years. Discuss the ratios, comparing results within and across companies.

Assume that total assets at the beginning of Year 1, including the box manufacturing equipment, had a value of $30,300. Assume that depreciation expense on assets other than the box manufacturing equipment totaled $1,000 per year.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie