Exhibits 1.26??1.28 of Integrative Case 1.1 (Chapter 1) present the financial statements for Walmart for 2012 to

Question:

Exhibits 1.26??1.28 of Integrative Case 1.1 (Chapter 1) present the financial statements for Walmart for 2012 to 2015. In addition, the website for this text contains Walmart??s December 31, 2015, Form 10-K. You should read the management discussion and analysis (MD&A), financial statements, and notes to the financial statements, especially Note 2, ????Summary of Significant Accounting Policies.????

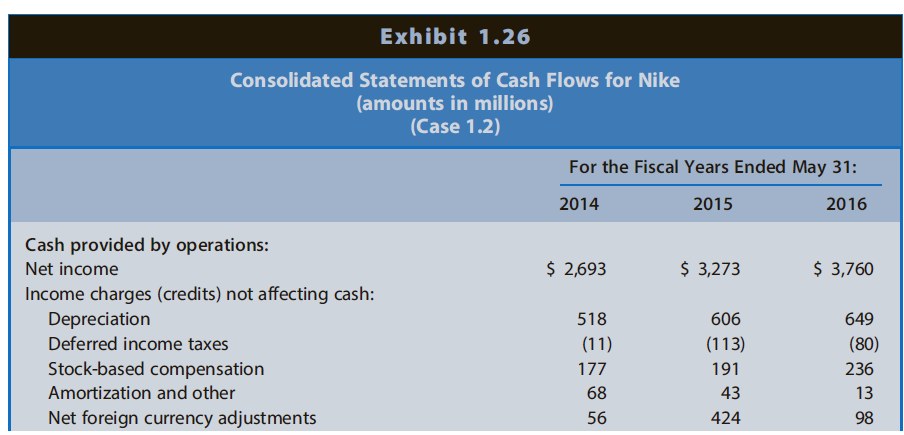

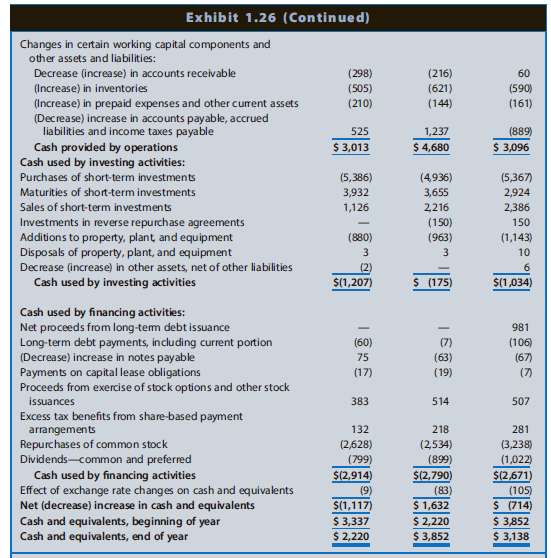

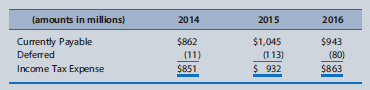

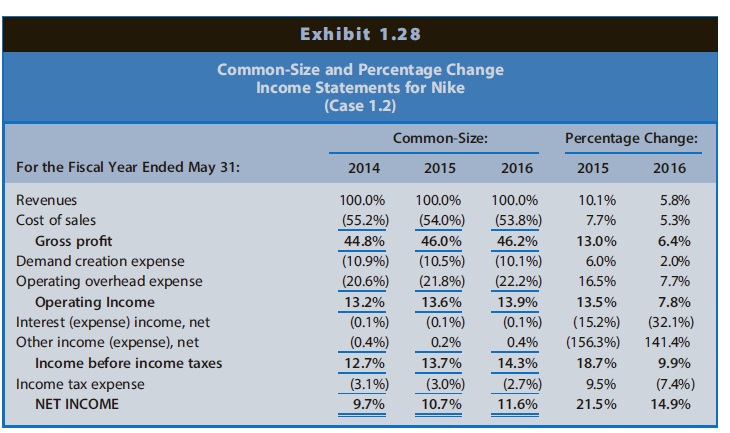

Exhibit 1.27

Excerpts from Notes to Consolidated Financial Statements for Nike (amounts in millions) (Case 1.2)Excerpts from the Summary of Significant Accounting Policies

- Revenue Recognition: Nike recognizes wholesale revenues when title and the risks and rewards of ownership have passed to the customer, based on the terms of sale. This occurs upon shipment or upon receipt by the customer depending on the country of the sale and the agreement with the customer. Retail store revenues are recorded at the time of sale and online store revenues are recorded upon delivery to the customer. Provisions for post-invoice sales discounts, returns and miscellaneous claims from customers are estimated and recorded as a reduction to revenue at the time of sale.

- Allowance for Uncollectible Accounts Receivable: Accounts receivable, net consist primarily of amounts receivable from customers. The Company makes ongoing estimates relating to the collectability of its accounts receivable and maintains an allowance for estimated losses resulting from the inability of its customers to make required payments. In determining the amount of the allowance, the Company considers historical levels of credit losses and makes judgments about the creditworthiness of significant customers based on ongoing credit evaluations. The allowance for uncollectible accounts receivable was $43 million and $78 million at May 31, 2016 and 2015, respectively.

- Demand Creation Expense: Demand creation expense consists of advertising and promotion costs, including costs of endorsement contracts, television, digital and print advertising, brand events and retail brand presentation. Advertising production costs are expensed the first time an advertisement is run.

- Inventory Valuation: Inventories are stated at lower of cost or market and valued on either an average or specific identification cost basis. For inventories in transit that represent direct shipments to customers, the related inventory and cost of sales are recognized on a specific identification basis. Inventory costs primarily consist of product cost from the Company??s suppliers, as well as inbound freight, import duties, taxes, insurance and logistics and other handling fees.

- Property, Plant and Equipment and Depreciation: Property, plant and equipment are recorded at cost. Depreciation is determined on a straight-line basis for buildings and leasehold improvements over 2 to 40 years and for machinery and equipment over 2 to 15 years.

- Identifiable Intangible Assets and Goodwill: This account represents the excess of the purchase price of acquired businesses over the market values of identifiable net assets, net of amortization to date on assets with limited lives.

- Income Taxes: The Company accounts for income taxes using the asset and liability method. This approach requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of temporary differences between the carrying amounts and the tax basis of assets and liabilities. Income tax expense includes the following:

- Stock Repurchases: Nike repurchases outstanding shares of its common stock each year and retires them. Any difference between the price paid and the book value of the shares appears as an adjustment of retained earnings.

An intangible asset is a resource controlled by an entity without physical substance. Unlike other assets, an intangible asset has no physical existence and you cannot touch it.Types of Intangible Assets and ExamplesSome examples are patented... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Common Stock

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Reporting Financial Statement Analysis and Valuation a strategic perspective

ISBN: 978-1337614689

9th edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Question Posted: