Sony Corporation manufactures and markets consumer electronics products. Assume the following are selected income statement data for

Question:

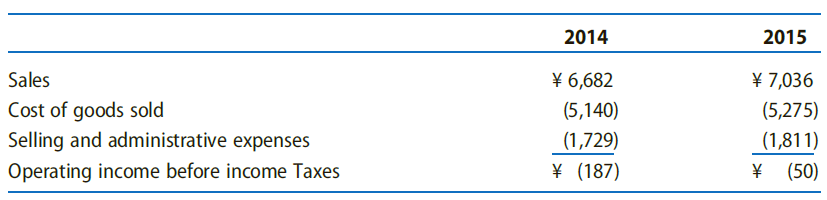

Sony Corporation manufactures and markets consumer electronics products. Assume the following are selected income statement data for 2014 and 2015 (amounts in billions of yen):

REQUIREDa. Estimate the variable cost as a percentage of sales for the cost of goods sold by dividing the amount of the change in the cost of goods sold by the amount of the change in sales. Then multiply the variable-cost percentage times sales to estimate the total variable cost. Subtract the variable cost from the total cost to estimate the fixed cost for cost of goods sold. Follow this procedure to determine the cost structure (fixed cost plus variable cost as a percentage of sales) for cost of goods sold for Sony.b. Repeat Requirement a for selling and administrative expenses.c. Suppose that Sony Corporation discloses that it expects sales to grow at the following rates in future years: Year +1, 12%; Year +2, 10%; Year +3, 8%; Year +4, 6%. Project sales, cost of goods sold, selling and administrative expenses, and operating income before income taxes for Sony for Year +1 to Year +4 using the cost structure amounts derived in Requirements a and b.d. Compute the ratio of operating income before income taxes to sales for Year +1 through Year +4.e. Interpret the changes in the ratio computed in Requirement d in light of the expected changes in sales.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Financial Reporting Financial Statement Analysis and Valuation a strategic perspective

ISBN: 978-1337614689

9th edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw