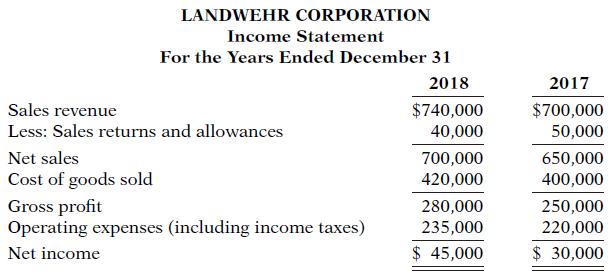

Condensed balance sheet and income statement data for Landwehr Corporation appear below. Additional information: 1. The market

Question:

Condensed balance sheet and income statement data for Landwehr Corporation appear below.

Additional information:

1. The market price of Landwehr’s common stock was $4.00, $5.00, and $8.00 for 2016, 2017, and 2018, respectively.

2. All dividends were paid in cash.

Instructions

(a) Compute the following ratios for 2017 and 2018.

(1) Profit margin.

(2) Asset turnover.

(3) Earnings per share. (Weighted-average common shares in 2018 were 32,000 and in 2017 were 31,000.)

(4) Price-earnings ratio.

(5) Payout ratio.

(6) Debt to assets ratio.

(b) Based on the ratios calculated, discuss briefly the improvement or lack thereof in financial position and operating results from 2017 to 2018 of Landwehr Corporation.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Accounting Principles

ISBN: 978-1118875056

12th edition

Authors: Jerry Weygandt, Paul Kimmel, Donald Kieso