Question: Refer to the information for Adrian Express in E125. Industry averages for the following profitability ratios are as follows: Gross profit ratio ............................ 45% Return

Refer to the information for Adrian Express in E12–5. Industry averages for the following profitability ratios are as follows:

Gross profit ratio ............................ 45%

Return on assets ............................ 25%

Profit margin ................................... 15%

Asset turnover ................................ 2.5 times

Return on equity ........................... 35%

Required:

1. Calculate the five profitability ratios listed above for Adrian Express.

2. Do you think the company is more profitable or less profitable than the industry average? Explain your answer.

E12–5

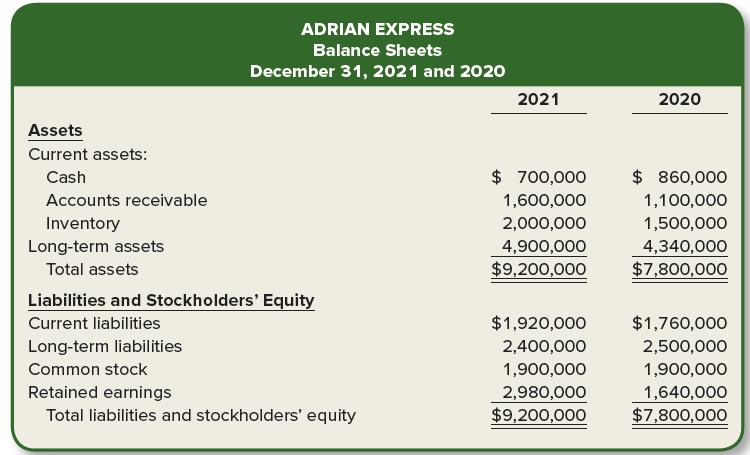

The 2021 income statement of Adrian Express reports sales of $19,310,000, cost of goods sold of $12,250,000, and net income of $1,700,000. Balance sheet information is provided in the following table.

Industry averages for the following four risk ratios are as follows:

Average collection period ................ 25 days

Average days in inventory ............... 60 days

Current ratio ........................................... 2 to 1

Debt to equity ratio ............................ 50%

ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 2021 2020 Assets Current assets: $ 700,000 1,600,000 Cash $ 860,000 Accounts receivable 1,100,000 Inventory 2,000,000 1,500,000 4,340,000 $7,800,000 Long-term assets 4,900,000 $9,200,000 Total assets Liabilities and Stockholders' Equity $1,920,000 2,400,000 Current liabilities $1,760,000 Long-term liabilities Common stock 2,500,000 1,900,000 1,900,000 Retained earnings 2,980,000 $9,200,000 1,640,000 $7,800,000 Total liabilities and stockholders' equity

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

ANSWER Gross profit in Step 1 equals sales minus the cost of goods sold 1931000012250000 706000... View full answer

Get step-by-step solutions from verified subject matter experts