Question: The balance sheets for Plasma Screens Corporation and additional information are provided below. Additional Information for 2021: 1. Net income is $184,000. 2. Sales on

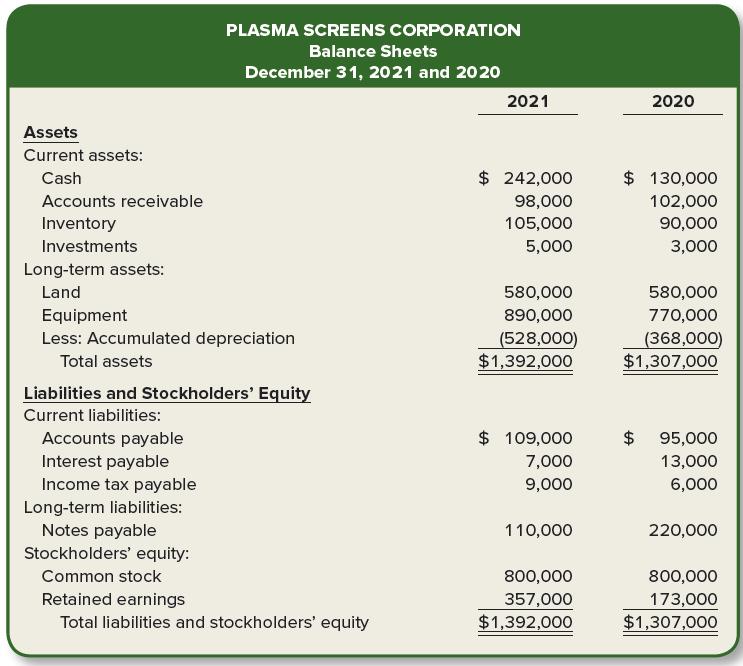

The balance sheets for Plasma Screens Corporation and additional information are provided below.

Additional Information for 2021:

1. Net income is $184,000.

2. Sales on account are $1,890,000.

3. Cost of goods sold is $1,394,250.

Required:

1. Calculate the following risk ratios for 2021:

a. Receivables turnover ratio.

b. Inventory turnover ratio.

c. Current ratio.

d. Acid-test ratio.

e. Debt to equity ratio.

2. When we compare two companies, can one have a higher current ratio while the other has a higher acid-test ratio? Explain your answer.

PLASMA SCREENS CORPORATION Balance Sheets December 31, 2021 and 2020 2021 2020 Assets Current assets: Cash $ 242,000 $ 130,000 Accounts receivable 98,000 102,000 Inventory 105,000 90,000 Investments 5,000 3,000 Long-term assets: Land 580,000 580,000 Equipment 890,000 770,000 (528,000) $1,392,000 Less: Accumulated depreciation (368,000) $1,307,000 Total assets Liabilities and Stockholders' Equity Current liabilities: $ 109,000 Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: $ 95,000 7,000 13,000 9,000 6,000 110,000 220,000 Common stock 800,000 800,000 Retained earnings 357,000 $1,392,000 173,000 $1,307,000 Total liabilities and stockholders' equity

Step by Step Solution

3.48 Rating (168 Votes )

There are 3 Steps involved in it

1 a Receivable turnover ratio Net salesAverage Accounts receivable Net sales 1890000 Average account... View full answer

Get step-by-step solutions from verified subject matter experts