The following financial data are available for each of two manufacturers of mountain bikes. Required: Compute and

Question:

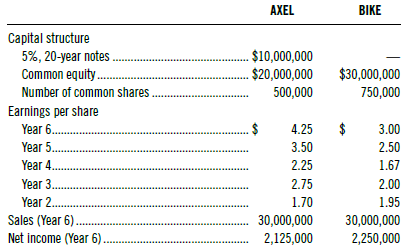

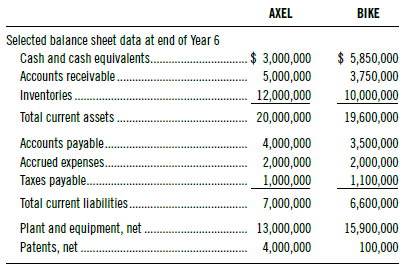

The following financial data are available for each of two manufacturers of mountain bikes.

Required:

Compute and analyze each of the following seven factors and ratios. For each factor and ratio, does the evidence imply a higher or lower PE for Axel or Bike?

a. Growth in earnings per share.

b. Financial leverage ratio.

c. Return on common equity.

d. Net income as % of sales.

e. Current ratio, receivables turnover, and sales to plant and equipment.

f. Patent position.

g. Return on long-term assets.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Statement Analysis

ISBN: 978-0073379432

10th edition

Authors: K. R. Subramanyam, John J. Wild

Question Posted: