A portfolio manager considers the following annual coupon bonds: Calculate the yield spread and G-spread for the

Question:

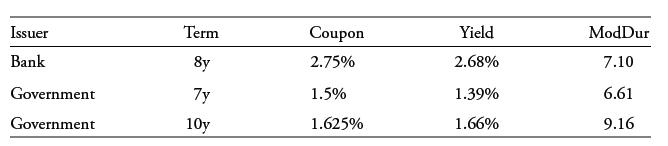

A portfolio manager considers the following annual coupon bonds:

Calculate the yield spread and G-spread for the bank bond.

Transcribed Image Text:

Issuer Bank Government Government Term 8y 7y 10y Coupon 2.75% 1.5% 1.625% Yield 2.68% 1.39% 1.66% ModDur 7.10 6.61 9.16

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

Yield spread for the bank bond is 1290 or the simple difference between the 268 bank ...View the full answer

Answered By

Cristine kanyaa

I possess exceptional research and essay writing skills. I have successfully completed over 5000 projects and the responses are positively overwhelming . I have experience in handling Coursework, Session Long Papers, Manuscripts, Term papers, & Presentations among others. I have access to both physical and online library. this makes me a suitable candidate to tutor clients as I have adequate materials to carry out intensive research.

4.90+

1538+ Reviews

3254+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

A portfolio manager considers the following annual coupon bonds: An increase in expected inflation causes the government yield curve to steepen, with a 20-point rise in the 10-year government bond...

-

An active credit portfolio manager considers the following corporate bond portfolio choices familiar from an earlier example: The investor anticipates an economic slowdown in the next year that will...

-

An active credit portfolio manager considers the following corporate bond portfolio choices familiar from an earlier example: The investor anticipates an economic slowdown in the next year that will...

-

I need one or more queries on the basis of database of netflix. I can upload the picture of database Create Index Modify Table Schema Delete Table Print CREATE TABLE Dates ( [PK] INTEGER PRIMARY KEY...

-

When considering the implementation of a project in one of various possible countries, what types of tax characteristics should be assessed among the countries?

-

The price of cod is much higher today than it was 30 years ago. Using demand and supply diagrams, explain why this should be so.

-

What happens if you specify an invalid format string?

-

Kwikeze Company set the following standard costs for one unit of its product. Direct materials (4.5 Ibs. @ $6 per Ib.) . . . . . . . $27.00 Direct labor (1.5 hrs. @ $12 per hr.) . . . . . . . . ....

-

Commencing 1 April 2022, Morgan Landscaping Pty Ltd (morgan) provided Larissa (an employee) with the use of a Volkswagen Golf car. The car cost $55,000 (including GST) and was used privately every...

-

A high-yield bond fund manager is considering adding a US$50 million face value, fiveyear, 6.75% semiannual coupon bond with a YTM of 5.40% to an active portfolio. The manager uses regression...

-

Which of the following best describes the expected shape of the credit spread curve in an economic downturn? A. Investment-grade and high-yield issuers usually experience similar credit spread curve...

-

The attachment of the N-protected C-terminal amino acid to the polymer in solid-phase peptide synthesis (Figure 17.7) is an SN2 displacement reaction. What is the nucleophile? What is the leaving...

-

3. Consider an elastic string that is originally Im long. a. Stretch it by 1cm, then by 10cm and finally by 40cm from its original length. For each stage calculate the engineering and true strains. 1...

-

1. Deduce the value of a dimensionless constant, n and dimensions of quantity, K in the following equations, to make them valid physical relations: Po pg 1 Vn P pg 2 g = + K (b) F=37KD"V + pV"D" 9T...

-

A a = 3.8 m b = 3.5 m c = 4 m F = 6 kN w = 2.6 kN/m simply-supported beam is subjected to the forces shown below. The dimensions of the beam and the values of the forces are: Determine the support...

-

2. Plot Crack tip plastic zone shapes estimated from the elastic solution and the von Mises yield criterion. 1) For Plane Stress, 2) For Plane Strain, 1) For Plane Stress, r., (0) 2) For Plane...

-

What happens when you throw the ball at some angle other than 9 0 o ? Does this change the time of flight? Explain. Can you still determine the maximum height and the initial speed? Explain.

-

At the end of September, Ron Ferlito decided to open his own typing service. Analyze the following transactions he completed by recording their effects in the expanded accounting equation. a....

-

A manufacturer can sell product 1 at a profit of $20 per unit and product 2 at a profit of $40 per unit. Three units of raw material are needed to manufacture one unit of product 1, and six units of...

-

Collins Corporation pays a $30,000 alternative minimum tax in the current year. What AMT benefit (if any) is available to reduce federal income taxes paid in a prior tax year, in the current tax...

-

The accumulated earnings tax is effectively a penalty on corporations. a. What is the purpose of the accumulated earnings tax? b. Why does the reasonable needs of the business exception either reduce...

-

Acme Corporation is a highly profitable closely held corporation that has never paid a dividend. During the past five years, after-tax earnings of $200,000 per year have been retained in the...

-

Can you explain how the yellow fields were calculated? Financial Plan Stock at Retail 01 02 03 04 05 06 (Shown in Millions) Feb Mar Apr May Jun Jul Total BOS/BOM STOCK SALES (-) $5,783.80 RECEIPTS...

-

A solid cylinder of radius 9.7 cm and mass 16 kg starts from rest and rolls without slipping a distance L = 7.9 m down a roof that is inclined at angle = 31. (a) What is the angular speed of the...

-

Two ropes are attached to a heavy box to pull it along the floor. One rope applies a force of 585 newtons in a direction due west; the other applies a force of 350 newtons in a direction due south....

Study smarter with the SolutionInn App