Alfred Simonsson is assistant treasurer at a Swedish lumber company. The company has sold a large tract

Question:

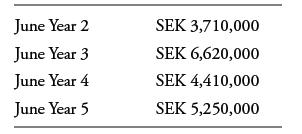

Alfred Simonsson is assistant treasurer at a Swedish lumber company. The company has sold a large tract of land and now has sufficient cash holdings to retire some of its debt liabilities. The company’s accounting department assures Alfred that its external auditors will approve of a defeasement strategy if Swedish government bonds are purchased to match the interest and principal payments on the liabilities. Following is the schedule of payments due on the debt as of June Year 1 that the company plans to defease:

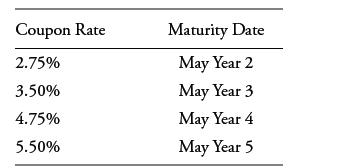

The following Swedish government bonds are available. Interest on the bonds is paid annually in May of each year.

How much in par value for each government bond will Alfred need to buy to defease the debt liabilities, assuming that the minimum denomination in each security is SEK 10,000?

Step by Step Answer: