As in the prior example, an active fixed-income manager anticipates an economic slowdown in the next year

Question:

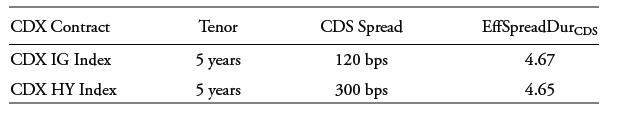

As in the prior example, an active fixed-income manager anticipates an economic slowdown in the next year with a greater adverse impact on lower-rated issuers. The manager chooses a tactical CDX (credit default swap index) strategy combining positions in investment-grade and high-yield CDX contracts to capitalize on this view. The current market information for investment-grade and high-yield CDX contracts is as follows:

Assume that both CDX contracts have a $10,000,000 notional with premiums paid annually, and that the EffSpreadDurCDS for the CDX IG and CDX HY contracts in one year are 3.78 and 3.76, respectively.

Calculate the one-year return on the tactical CDX strategy under an economic downturn scenario in which investment-grade credit spreads rise by 50% and highyield credit spreads double.

Step by Step Answer: