As in the prior example, an active fixed-income manager anticipates an economic slowdown in the next year

Question:

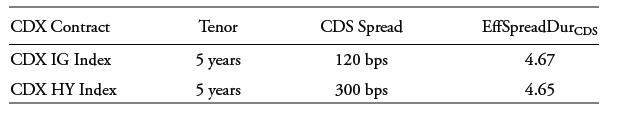

As in the prior example, an active fixed-income manager anticipates an economic slowdown in the next year with a greater adverse impact on lower-rated issuers. The manager chooses a tactical CDX (credit default swap index) strategy combining positions in investment-grade and high-yield CDX contracts to capitalize on this view. The current market information for investment-grade and high-yield CDX contracts is as follows:

Assume that both CDX contracts have a $10,000,000 notional with premiums paid annually, and that the EffSpreadDurCDS for the CDX IG and CDX HY contracts in one year are 3.78 and 3.76, respectively.

Describe the appropriate tactical CDX strategy, and calculate the one-year return assuming no change in credit spread levels.

Step by Step Answer: