Consider two $50 million portfolios: Portfolio A is fully invested in the 5-year Treasury bond, and Portfolio

Question:

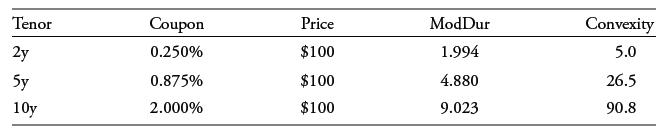

Consider two $50 million portfolios: Portfolio A is fully invested in the 5-year Treasury bond, and Portfolio B is an investment split between the 2-year (58.94%) and the 10-year (41.06%) bonds. The Portfolio B weights were chosen to (approximately) match the 5-year bond duration of 4.88. How will the value of these portfolios change if all three Treasury yields-to-maturity immediately rise or fall by 50 bps?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: