Which of the following derivatives strategies would best offset the yield curve exposure difference between the active

Question:

Which of the following derivatives strategies would best offset the yield curve exposure difference between the active and index portfolios?

A. Add a pay-fixed 10-year swap and long 2-year, 5-year, and 30-year bond futures positions to the active portfolio.

B. Add a receive-fixed 30-year swap, a pay-fixed 10-year swap, and short positions in 2-year and 5-year bond futures to the active portfolio.

C. Add a pay-fixed 10-year swap, a short 30-year bond futures, and long 2-year and 5-year bond futures positions to the active portfolio.

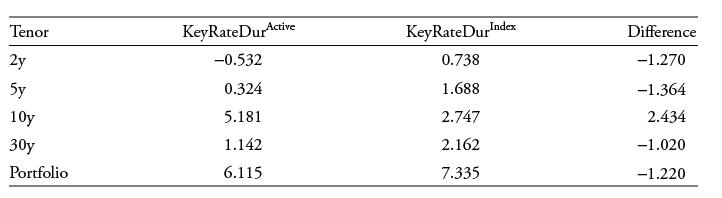

A financial analyst at an in-house asset manager fund has created the following spreadsheet of key rate durations to compare her active position to that of a benchmark index so she can compare the rate sensitivities across maturities.

Step by Step Answer: