Which of the following statements best describes the forward rate bias? A. Investors tend to favor fixed-income

Question:

Which of the following statements best describes the forward rate bias?

A. Investors tend to favor fixed-income investments in currencies that trade at a premium on a forward basis.

B. Investors tend to hedge fixed-income investments in higher-yielding currencies given the potential for lower returns due to currency depreciation.

C. Investors tend to favor unhedged fixed-income investments in higher-yielding currencies that are sometimes enhanczed by borrowing in lower-yielding currencies.

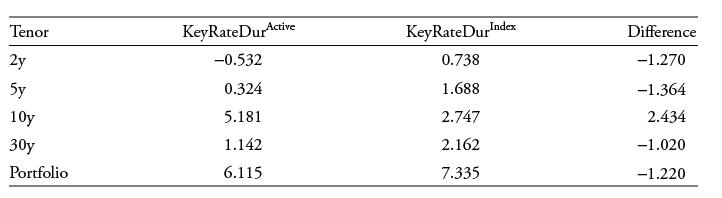

A financial analyst at an in-house asset manager fund has created the following spreadsheet of key rate durations to compare her active position to that of a benchmark index so she can compare the rate sensitivities across maturities.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: