Which of the following statements best characterizes how the active portfolio is positioned for yield curve changes

Question:

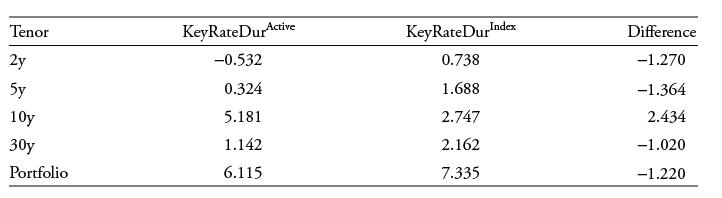

Which of the following statements best characterizes how the active portfolio is positioned for yield curve changes relative to the index portfolio?

A. The active portfolio is positioned to benefit from a bear steepening of the yield curve versus the benchmark portfolio.

B. The active portfolio is positioned to benefit from a positive butterfly movement in the shape of the yield curve versus the index.

C. The active portfolio is positioned to benefit from yield curve flattening versus the index.

A financial analyst at an in-house asset manager fund has created the following spreadsheet of key rate durations to compare her active position to that of a benchmark index so she can compare the rate sensitivities across maturities.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: