Jasmines Dresswear Manufacturers is preparing a strategy for the fall season. One alternative is to expand its

Question:

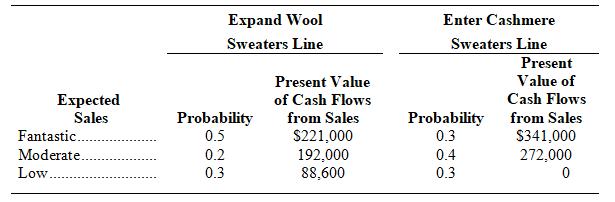

Jasmine’s Dresswear Manufacturers is preparing a strategy for the fall season. One alternative is to expand its traditional ensemble of wool sweaters. A second option would be to enter the cashmere sweater market with a new line of high-quality designer label products. The marketing department has determined that the wool and cashmere sweater lines offer the following probability of outcomes and related cash flows:

The initial cost to expand the wool sweater line is $142,000. To enter the cashmere sweater line, the initial cost in designs, inventory, and equipment is $102,000.

a. Diagram a complete decision tree of possible outcomes similar to Table 13-6. Note that you are dealing with thousands of dollars rather than millions. Take the analysis all the way through the process of computing expected NPV (the last column for each investment).

b. Given the analysis in part a, would you automatically make the investment indicated?

Step by Step Answer:

Foundations Of Financial Management

ISBN: 9781264097623

18th Edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen