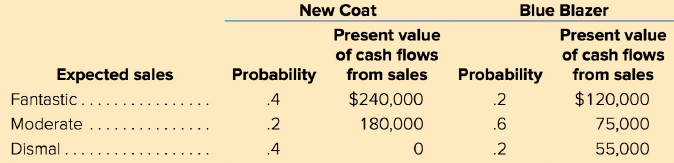

Wardrobe Clothing Manufacturers is preparing a strategy for the fall season. One strategy is to go to

Question:

The initial cost to get into the new coat line is $100,000 in designs, equipment, and inventory. To enter the blue blazer line the initial cost in designs, inventory, and equipment is $60,000.

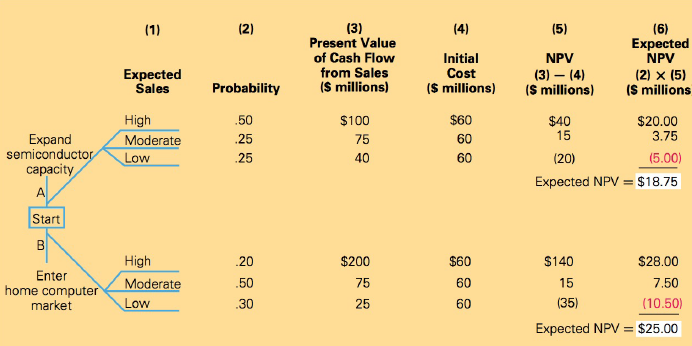

a. Diagram a complete decision tree of the possible outcomes similar to Figure 13-8. Take the analysis all the way through the process of computing expected NPV for each investment.

Figure 13-8

b. Given the analysis in part a, would you automatically make the investment indicated?

b. Given the analysis in part a, would you automatically make the investment indicated?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Question Posted: