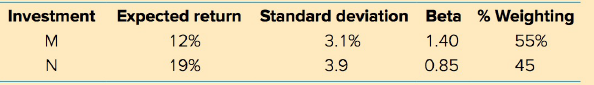

Astrid has the following two investments in her portfolio: a. Which investment is riskier by itself and

Question:

a. Which investment is riskier by itself and in a portfolio sense?

b. What is the expected return of the portfolio?

c. With a correlation coefficient of +0.30, what is the standard deviation of the portfolio?

d. What is the beta of the portfolio?

e. What is the significance of the results in parts a through a?

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Transcribed Image Text:

Investment Expected return Standard deviation Beta % Weighting 1.40 3.1% 3.9 55% 45 M 12% 0.85 19%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (6 reviews)

Astrid a Investment N is riskier by itself with the higher s...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Question Posted:

Students also viewed these Business questions

-

Jimmy has the following two investments in his portfolio: a. Which investment is riskier by itself and in a portfolio sense? b. What is the expected return of the portfolio? c. With a correlation...

-

An individual has $35,000 invested in a stock which has a beta of 0.8 and $40,000 invested in a stock with a beta of 1.4. If these are the only two investments in her portfolio, what is her...

-

An individual has $35,000 invested in a stock with a beta of 0.8 and another $40,000 invested in a stock with a beta of 1.4. If these are the only two investments in her portfolio, what is her...

-

An air-filled X-band rectangular waveguide has dimensions a = 2.286 cm and b = 1.016 cm. If the waveguide has copper walls ( = o , = o , = 5.8 x 10 7 S/m), find the attenuation in dB/m due to the...

-

The following table shows data from the Organization for Economic Co-operation and Development (OECD) on the average number of hours employed people worked per week and on real GDP per capita for...

-

A closed circuit consists of two semicircles of radii 40 and 20 cm that are connected by straight segments as shown in Figure. A current of 3.0 A flows around this circuit in the clockwise direction....

-

What natural disasters are associated with climate change?

-

1. Discuss at least five characteristics that predict relatively low disclosure levels in Mexico. Your response should be based on a review of the material presented in Chapters 2 and 4 and this...

-

KINDLY HELP ME WITH GOOD EXAMPLES OF EACH OF THE THREE FORMS OF MARKET EFFICIENCY TO BACK THE INFORMATION BELOW The three forms of market efficiency and an assessment of their plausibility First of...

-

Jamie Lee is reviewing her finances one month later. She has provided the actual amounts paid below. Use the cash budget table below to help her identify the variances in her budget. Each answer must...

-

Assume a corporation has earnings before amortization and taxes (EBAT) of $100,000 and amortization of $50,000, and it has a 34 percent tax rate. Compute its cash flow.

-

Wardrobe Clothing Manufacturers is preparing a strategy for the fall season. One strategy is to go to a highly imaginative, new, four-gold-button sports coat. The all-wool product would be available...

-

Write a query to display the book number, title, and cost of books that have the lowest cost of any books in the system. Sort the results by book number (Figure P7.105). Figure P7.105 Least Expensive...

-

An electrical circuit is built with a variable resistor installed. For each of the following resistance values (measured in kiloohms, k), the power corresponding to the load (measured in milliwatts,...

-

Jackman Company's general ledger shows a cash account balance of $23,310 on July 31, 2024. Cash sales of $1,867 for the last three days of the month have not yet been deposited. The bank statement...

-

Willow Creek Nursery, with an authorization of 18,000 shares of preferred stock and 320,000 shares of common stock, completed several transactions involving its stock on October 1, the first day of...

-

Tamarisk Company sold 400 copy-making machines in 2025 for $3,200 a piece, together with a one-year warranty. Repair costs for each machine during the warranty period average $340. Prepare entries to...

-

M Company operates a factory that is currently operating at 50% capacity. It is on track to make 40,000 units this year, but recently received a special order to make and sell 20,000 units for a...

-

For the given mathematical system, determine which of the five properties of a commutative group do not hold. ! ! ! !

-

Use the following data to answer the next two (2) questions: Product 1 Product 2 Product 3 Direct Material Cost $25,000 $30,000 $35,000 Direct Labor Cost $30,000 $40,000 $50,000 Direct Labor Hours...

-

In terms of the life of the securities offered, what is the difference between money and capital markets?

-

Explain the relationship between inventory turnover and purchasing needs.

-

What is meant by a step-up in the conversion price?

-

b) Find the solution of the following recurrence relations with the given initial conditions. Apply the iterative approach. anan-1+2n+3, ao = 4

-

2. You are working in the information technology department of a financial institute. You are required to develop a Java Program to assist the customer service department to provide good quality of...

-

3. Consider the following class definition and write an appropriate Java program according to the definition and output the result. public class Children [String name; int friends; public...

Study smarter with the SolutionInn App