DKNY owes Mex$7 million in 30 days for a recent shipment from Mexico. It faces the following

Question:

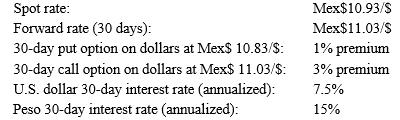

DKNY owes Mex$7 million in 30 days for a recent shipment from Mexico. It faces the following interest and exchange rates:

Suppose that DKNY expects the 30-day spot rate to be Mex$11.25/$. Should it hedge this payable? What other factors should go into DKNY’s hedging decision?

Transcribed Image Text:

Spot rate: Forward rate (30 days): 30-day put option on dollars at Mex$ 10.83/$: 30-day call option on dollars at Mex$ 11.03/$: U.S. dollar 30-day interest rate (annualized): Peso 30-day interest rate (annualized): Mex$10.93/$ Mex$11.03/S 1% premium 3% premium 7.5% 15%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

The key question here is where DKNYs comparative advantage lies Does ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Foundations Of Multinational Financial Management

ISBN: 9780470128954

6th Edition

Authors: Alan C Shapiro, Atulya Sarin

Question Posted:

Students also viewed these Business questions

-

DKNY owes Mex$7 million in 30 days for a recent shipment from Mexico. It faces the following interest and exchange rates: How can DKNY construct a currency collar? What is the net premium paid for...

-

Please calculate the Net Present Value for the following scenario: Outflow (investment) 100 Inflow (return) Today End of Year 1 End of Year 2 End of Year 3 End of Year 4 Assume: 200 250 300 350 ...

-

1. What hedging options are available to DKNY? 2. What is the hedged cost of DKNYs payable using a forward market hedge? 3. What is the hedged cost of DKNYs payable using a money market hedge? 4....

-

Arrange the following events in the correct temporal sequence during eukaryotic cell division, starting with the earliest: (a) condensation of the chromosomes, (b) Movement of chromosomes to the...

-

Using transaction data to prepare a statement of cash flowsDirect method Store Company engaged in the following transactions during the 2011 accounting period. The beginning cash balance was $28,600...

-

Purchasing Department cost drivers, activity-based costing, simple regression analysis Fashion Bling operates a chain of 10 retail department stores. Each department store makes its own purchasing...

-

If a mass on a spring moving horizontally were taken to the moon, how would its frequency change? What about a mass on a spring moving vertically? A pendulum?

-

Reboot Inc. provides computer repair services for the community. Ashley DaCostas computer was not working, and she called Reboot for a home repair visit. The Reboot Inc. technician arrived at 2:00 p....

-

Consider the following C++ code snippet: int bob = 50; if (bob < 0) { cout < < "Bob failed." ; } else if (bob >65) cout < < "Bob passed." ; else cout < < "Bob failed." ; What is printed on the system...

-

Studies have shown that in trade dealings between nations that have high and volatile inflation rates, most export prices are quoted in dollars. What might account for this finding?

-

Plantronics owes SKr50 million, due in one year, for some electrical equipment it recently bought from ABB Asea Brown Boveri. At the current spot rate of $0.1480/SKr, this payable is $7.4 million. It...

-

In Problem 5, assume that you want to reindex with the index value at the beginning of the year equal to 100. What is the index level at the end of the year?

-

How does the Deferral method handle an unrestricted contribution received for the current year?

-

1. Was the given stakeholder management effective in the Bhopal gas leak in 1984?

-

Please write one paper essay. Topic: Transportation and Urban Form Question: What role did transportation play in shaping the spatial structure of metropolitan areas in the United States?

-

Jane Jones is the only female mechanic in a garage owned by Central Transport Company. Jane and her fellow co-workers are routinely and systematically subject to a rude, obnoxious and downright mean...

-

When it gets hot outside, the level of crime increases. Using this statement, discuss the problems of trying to measure such a vague statement. Discuss the progression of moving from vague terms to...

-

Howard loaned $8,000 to Bud two years ago. The terms of the loan call for Bud to pay annual interest at 8%, with the principal amount due in three years. Until this year, Bud had been making the...

-

Planning: Creating an Audience Profile; Collaboration: Team Projects. Compare the Facebook pages of three companies in the same industry. Analyze the content on all available tabs. What can you...

-

Our cat Fred's summer kitty-cottage needs a new roof. He's considering the following two proposals and feels a 15-year analysis period is in line with his remaining lives. Which roof should he choose...

-

Don Garlits is a landscaper. He is considering the purchase of a new commercial lawn mower, either, the Atlas or the Zippy. The minimum attractive rate of return is 8%, and the table provides all the...

-

QZY, Inc. is evaluating new widget machines offered by three companies. The machines have the following characteristics: MARR = 15%. Using rate of return analysis, from which company, if any, should...

-

The daily demand for a spare engine part is a random variable with a distribution based on past experience, given by The part is expected to be obsolete after 400 days. Assume that demands from one...

-

Monitors manufactured by TSI Electronics have life spans that have a normal distribution with a variance of 1,960,000 and a mean life span of 20,000 hours. If a monitor is selected at random, find...

-

Many problems depend on the evolution of states over time. Consider the state space diagram below (inspired by the Hidden Markov Model) and answer the following questions. This week we are just...

Study smarter with the SolutionInn App