DKNY owes Mex$7 million in 30 days for a recent shipment from Mexico. It faces the following

Question:

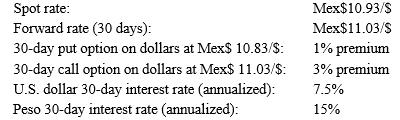

DKNY owes Mex$7 million in 30 days for a recent shipment from Mexico. It faces the following interest and exchange rates:

How can DKNY construct a currency collar? What is the net premium paid for the currency collar? Using this currency collar, what is the net dollar cost of the payable if the spot rate in 30 days is Mex$10.75/$? Mex$11.03/$? Mex$11.25/$?

Transcribed Image Text:

Spot rate: Forward rate (30 days): 30-day put option on dollars at Mex$ 10.83/$: 30-day call option on dollars at Mex$ 11.03/$: U.S. dollar 30-day interest rate (annualized): Peso 30-day interest rate (annualized): Mex$10.93/$ Mex$11.03/S 1% premium 3% premium 7.5% 15%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

DKNY can create a currency collar by simultaneously buying an outofthemoney put option and selling a...View the full answer

Answered By

ANDREW KIPRUTO

Academic Writing Expert

I have over 7 years of research and application experience. I am trained and licensed to provide expertise in IT information, computer sciences related topics and other units like chemistry, Business, law, biology, biochemistry, and genetics. I'm a network and IT admin with +8 years of experience in all kind of environments.

I can help you in the following areas:

Networking

- Ethernet, Wireless Airmax and 802.11, fiber networks on GPON/GEPON and WDM

- Protocols and IP Services: VLANs, LACP, ACLs, VPNs, OSPF, BGP, RADIUS, PPPoE, DNS, Proxies, SNMP

- Vendors: MikroTik, Ubiquiti, Cisco, Juniper, HP, Dell, DrayTek, SMC, Zyxel, Furukawa Electric, and many more

- Monitoring Systems: PRTG, Zabbix, Whatsup Gold, TheDude, RRDtoo

Always available for new projects! Contact me for any inquiries

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Foundations Of Multinational Financial Management

ISBN: 9780470128954

6th Edition

Authors: Alan C Shapiro, Atulya Sarin

Question Posted:

Students also viewed these Business questions

-

DKNY owes Mex$7 million in 30 days for a recent shipment from Mexico. It faces the following interest and exchange rates: Suppose that DKNY expects the 30-day spot rate to be Mex$11.25/$. Should it...

-

DKNY owes Mex$7 million in 30 days for a recent shipment from Mexico. It faces the following interest and exchange rates: What is the hedged cost of DKNYs payable using a put option? Spot rate:...

-

DKNY owes Mex$7 million in 30 days for a recent shipment from Mexico. It faces the following interest and exchange rates: What is the hedged cost of DKNY's payable using a forward market hedge? Spot...

-

Exhibits 7.17 and 7.18 provide footnote excerpts to the financial reports of The Coca-Cola Company and Eli Lilly and Company that discuss the stock option grants given to the employees of the two...

-

The direct versus the indirect method of determining cash flows from operating activities The following accounts and corresponding balances were drawn from Larry Company's 2012 and 2011 y ear -end...

-

Weighted-average method, assigning costs. Bio Doc Corporation is a biotech company based in Milpitas. It makes a cancer-treatment drug in a single processing department. Direct materials are added at...

-

Fat cells in humans are composed almost entirely of pure triglycerides with an average density of about 900 kg/m 3 . If 20% of the mass of a 70 kg students body is fat (a typical value), what is the...

-

Henry was owed $10,000 by Jones Corp. In consideration of the many odd jobs performed for him over the years by his nephew, Henry assigned the $10,000 claim to his nephew Charles. Henry died, and his...

-

Suppose you are working as an inventory manager with Walmart. You are assigned with the task to determine EOQ for a batch of order containing three different items. The respective annual demand for...

-

International Worldwide would like to execute a money market hedge to cover a 250,000,000 shipment from Japan of sound systems it will receive in six months. The current exchange rate is 124 = $1. a....

-

Can hedging provide protection against expected exchange rate changes? Explain.

-

For the following exercises, write the first four terms of the sequence. a n = 16/n + 1

-

(d) Describe (with the help of a diagram) the nature of the Nash bargaining solution (NBS), where both Sarah and Josh influence the outcome.

-

XYZ Corporation is considering investing in bonds issued by ABC Inc. What is the primary factor influencing the choice between accounting models for bond investments under IFRS 9 for XYZ Corporation?

-

What mechanisms underlie the phenomenon of emergent properties in complex ecological systems, and how do these properties manifest at different scales of organization, from individuals to ecosystems?

-

Run a multiple regression with the dependent variable of quantity demanded of heating oil and the independent variables of price and income. According to your regression results, which of the...

-

Please use three or more of the following concepts as applied to the following case that involves you or someone else whose story you know in an organization dealing in some way with a challenge of...

-

Cassandra owns her own business and drives her van 15,000 miles a year for business and 5,000 miles a year for commuting and personal use. She purchases a new van in 2011 and wants to claim the...

-

6. (Potential Energy and Conservation of Energy) What should be the spring constant k of a spring designed to bring a 1200-kg car to rest from a speed of 95 km/h so that the occupants undergo a...

-

Consider three alternatives, each with a 10-year useful life. If the MARR is 10%, which alternative should be selected? Solve the problem by benefit-cost ratio analysis. A B $150 Cost $800 $300...

-

An investor is considering buying some land for $100,000 and constructing an office building on it. Three different buildings are being analyzed. *Resale value to be considered a reduction in cost,...

-

Using benefit-cost ratio analysis, determine which one of the three mutually exclusive alternatives should be selected. Each alternative has a 6-year useful life. Assume a 10% MARR A $560 $340 $120...

-

A 16-100th pinion drives the double-reduction helical-gear train in the figure. The transmitted power is 5 hp. All gears have 25 normal pressure angle and 20 as helix angle. Pinion 2 rotates cow at...

-

Calculate the beta of security D with the S&P. Year A, % B, % C, % D, % E, % 1 S&P, % 10.67-3.76 12.98 25.51 8.96 0.34 2 12.54 21.67 45.23 18.97 29.67 15.94 3 -8.82 19.84 16.52 -11.57-12.07 4.66 4...

-

The figure below shows a tank used to collect rainwater having a diameter of 5 m. As shown in the figure, the depth of the tank varies linearly from 2.5 m at its center to 2 m along the perimeter....

Study smarter with the SolutionInn App