DKNY owes Mex$7 million in 30 days for a recent shipment from Mexico. It faces the following

Question:

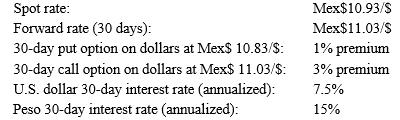

DKNY owes Mex$7 million in 30 days for a recent shipment from Mexico. It faces the following interest and exchange rates:

At what exchange rate is the cost of the put option just equal to the cost of the forward market hedge? to the cost of the money market hedge?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations Of Multinational Financial Management

ISBN: 9780470128954

6th Edition

Authors: Alan C Shapiro, Atulya Sarin

Question Posted: