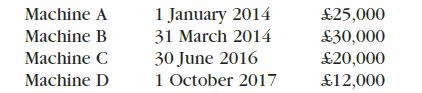

For Morris Ltd, the following machinery is purchased: Depreciation is to be charged at 20% on cost

Question:

For Morris Ltd, the following machinery is purchased:

Depreciation is to be charged at 20% on cost based on the value of machinery at the end of year. No depreciation is provided in the year of disposal of any asset.

On 27 July 2017, machine B was sold for £7,000.

(a) Construct the following accounts:

(i) Machinery at cost for the years ended 31 December 2014 to 2017 (ii) Provision for depreciation of machinery for the years ended 31 December 2014 to 2017 (iii) Machinery disposal for the year ended 31 December 2017.

(b) Produce a statement of financial position extract showing the machinery as at 31 December 2017.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Frank Woods Business Accounting Basics

ISBN: 9780273725008

1st Edition

Authors: Frank Wood, Mr David Horner

Question Posted: