Jean Marsh owns a small business making and selling children's toys. The following trial balance was extracted

Question:

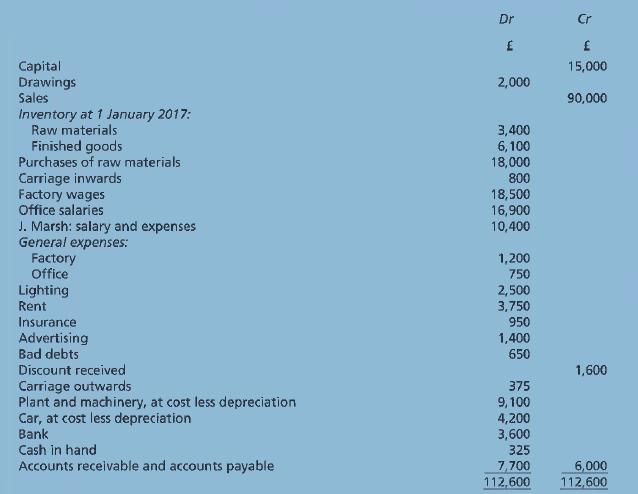

Jean Marsh owns a small business making and selling children's toys. The following trial balance was extracted from her books on 31 December 2017.

You are given the following additional information.

1 Inventory at 31 December 2017

![]()

There was no work-in-progress.

2 Depreciation for the year is to be charged as follows:

![]()

3 At 31 December 2017 insurance paid in advance was £150 and office general expenses unpaid were £75.

4 Lighting and rent are to be apportioned: 4/5 Factory, 1/5 Office. Insurance is to be apportioned: 3/4 Factory,1/5 Office.

5 Jean is the business's salesperson and her salary and expenses are to be treated as a selling expense. She has sole use of the business's car.

Questions:

For the year ended 31 December 2017 prepare

(a) the manufacturing account showing prime cost and factory cost of production.

(b) the trading account section of the statement of profit or loss.

(c) the profit and loss account section of the statement of profit or loss, distinguishing between administrative and selling costs.

(d) a statement of financial position as at 31 December 2017.

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9781292084664

13th Edition

Authors: Alan Sangster, Frank Wood