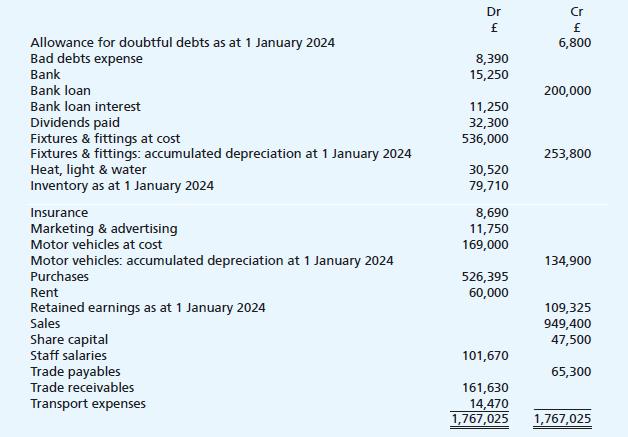

The trial balance below represents a summary of the balances on the nominal ledger of Banega Ltd

Question:

The trial balance below represents a summary of the balances on the nominal ledger of Banega Ltd (a wholesaler of hats and headwear) as at 31 December 2024:

The following issues also need to be dealt with in preparing the financial statements:

(i) The following two errors require correction: i) a cheque payment to a supplier for £9,300 has been recorded in the books as £3,900; and ii) a purchase invoice for 200 top hats totalling £7,700 has been posted twice by mistake.

(ii) On 31 December 2024, the company’s inventory was counted and valued at its cost price of £87,600. Included in this total is a batch of bowler hats that have proved very difficult to sell.

The batch originally cost £7,900. Management have recently identified a buyer for these hats who has agreed to pay 75% of cost price for the entire batch. Delivery costs will have to be paid for by Banega Ltd and are expected to amount to £550.

(iii) The rent on the business premises has been £48,000 per year for several years, which is payable half-yearly in advance on 31 March and 30 September. Both instalments were indeed paid in 2024, but the adjustment for the prepaid element of the second instalment has not yet been posted. Furthermore, negotiations with the landlord regarding the level of rent have been protracted and ongoing, and only in January 2025 was it finally agreed that the annual rent would rise by 10% effective as of 30 June 2024.

(iv) The auditors’ fees and expenses for the year are expected to be £21,000.

(v) On 23 December 2024, one of the directors traded-in her company car (an MPV) for a new SUV.

The MPV had originally been purchased by the company for £75,000 on 1 August 2021. The list price of new SUV was £96,000 but the part-exchange value of the MPV meant that the company will only pay £61,000 in full settlement to acquire the new vehicle. This £61,000 will be payable on 23 January 2025. However, no aspect of this transaction has yet been reflected in the books of the company.

(vi) Depreciation is to be charged at:

• 20% reducing balance on the fixtures and fittings • 20% straight line on the motor vehicles.

Company policy is to calculate a full year’s charge in the year of acquisition and none in the year of disposal.

(vii) The company’s credit controller has carefully reviewed all the trade receivables balances as at the year end and she has determined that debts of £13,400 need to be written off and that the allowance for doubtful debts should be set at £5,900.

(viii) During the year, 50,000 new ordinary shares of par (or ‘nominal’) value 5p each were issued for 75p each, paid in full on issue. This transaction has been accounted for by posting the entire proceeds to the share capital account.

(ix) The bank loan was taken out on 1 August 2022 and is repayable in full on 31 July 2027. Interest is charged at a fixed annual rate of 6.75% and is paid in quarterly instalments.

(x) The corporation tax charge on the profit for the year is estimated to be £29,500 (you should assume that this estimate is unaffected by the various matters above).

Required:

Prepare, in a publishable format, the income statement for Banega Ltd for the year ended 31 December 2024 followed by the balance sheet as at that date.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood