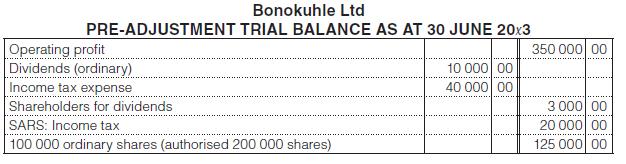

Bonokuhle Ltd is a public company that makes electrical components. 10 000 redeemable preference shares were

Question:

Bonokuhle Ltd is a public company that makes electrical components.

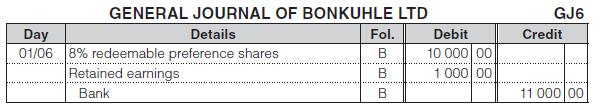

• 10 000 redeemable preference shares were redeemed on 1 June 20x3 at a premium of 10%. The only entry made, when this was done, was:

• The directors have the authority to issue the remaining authorised share capital (ordinary and preference) up to the next annual general meeting and can also redeem the preference shares, at their option, at a premium of 10% from 1 January 20x3 to 1 January 20x6. By that time all preference shares must be redeemed.

• The debentures are redeemable in full on 30 June 20x7. Interest is paid annually on the first day of March and accrues from month to month.

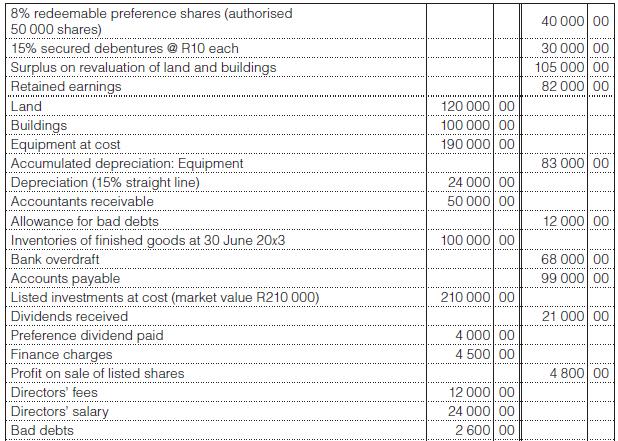

• On 15 January 19x6, the land was bought at a cost of R80 000.

– On 1 August 20x2, the property was revalued by Mr Conrad, a sworn valuer, using an existing basis.

– On 15 May 20x3, improvements costing R35 000 were made to the buildings.

– The property consists of a factory situated on Erf 7823, Johannesburg.

– This property was used as security for the debenture holders.

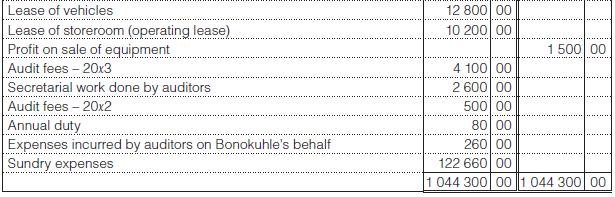

You are required to:

Prepare the statement of financial position, statement of changes in equity and statement of profit or loss & other comprehensive income of Bonokuhle Ltd at 30 June 20x3, with the appropriate notes.

Disclosure should conform to the minimum requirements of the Companies Act 71 of 2008, as amended and International Financial Reporting Standards. (Ignore dividend tax and comparative figures are not required.)

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit