Dr James Smith has a successful dental practice. An extract was taken from his records. These balances,

Question:

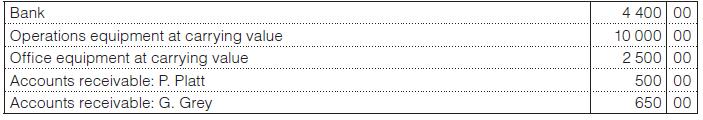

Dr James Smith has a successful dental practice. An extract was taken from his records. These balances, excluding the capital invested, were extracted for March:

Transactions for March (source document numbers in brackets):

2 Dr Smith increased his capital by depositing R1 000 in his the bank account (D/S 71).

8 Total of cash received from patients R760 (C/S 110–120).

12 Sold an old typewriter at carrying value and received R300 (R11).

16 P. Platt paid R200 on account (R12).

Banked all cash in till received from patients, R640 (C/S 121–130).

20 Sold old dental equipment at carrying value to Dr P. Bandy and received his cheque for R2 000 (R13).

22 Received a cheque from G. Grey for R650 in full settlement of his account (R14).

24 Mrs L. Brown sent us a cheque for R100 for the rental of the storeroom let to her (R15).

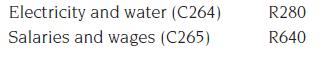

26 Paid by EFT:

You are required to:

1. Enter the transactions into the ledger accounts.

2. Prepare the trial balance.

3. Prepare a statement of profit or loss & other comprehensive income and statement of financial position for Dr Smith as at 31 March.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit