Eden and Stein were in partnership, sharing profits and losses in the ratio 2 : 1. Their

Question:

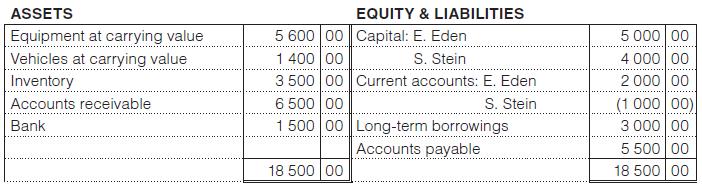

Eden and Stein were in partnership, sharing profits and losses in the ratio 2 : 1. Their abridged statement of financial position as at 31 March 20x5 was:

• The partnership was sold to Diamond Ltd as a going concern. The company was incorporated with a registered capital of 20 000 ordinary shares of R1 each.

• The partnership paid R450 and Diamond Ltd R1 000 for expenses for the transfer.

The agreement was as follows:

1. Eden would take over one vehicle at book value, that is, R800, and Stein would take over the other vehicle at R1 100.

2. Diamond Ltd would take over all assets and liabilities with the exception of bank and vehicles.

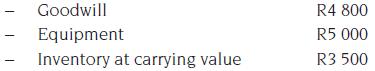

3. The assets were taken over at these valuation amounts:

– Accounts receivable at carrying value less an allowance for bad debts at 10%.

4. Diamond Ltd upon taking transfer would immediately pay off the loan.

5. Diamond Ltd would pay R1 650 in cash and the rest in shares. The shares were divided between Eden and Stein in the profit-sharing ratio.

6. The available cash would be divided between Eden and Stein in the profit-sharing ratio.

The shares would be divided between Eden and Stein in order to clear the outstanding capital accounts to nil.

You are required to:

1. Draw up the realisation account to show the necessary entries pertaining to the sale of the partnership.

2. Draw up the capital accounts of the partners (in columnar form) in the general ledger.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit