Lock, Stock and Barrel were in partnership sharing profits and losses in the ratio 3:2:1 respectively. Their

Question:

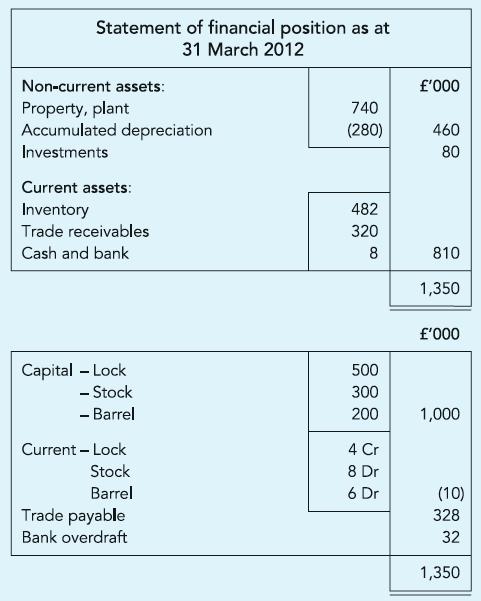

Lock, Stock and Barrel were in partnership sharing profits and losses in the ratio 3:2:1 respectively. Their Statement of financial position as at 31.3.2012 was prepared as shown. They decided to form a company to take over the business on the following basis:

(a) Lock would take over the investments, valuing them for the purpose at £95,000, and also take responsibility for the bank overdraft.

(b) LSB Ltd will take over the business as a going concern for a consideration to be discharged as follows:

■ Allotment to the partners, in their profit sharing ratio, of 800,000 ordinary shares of £1 each at 1.20p each;

■ Issue to Lock of £100,000 6% Loan note at par; and

■ Payment of £20,000 in cash. The decisions were carried out and expenses of dissolution were met at £3,000.

Required:

(a) Set out the closure of the partnership books.

(b) Assuming that LSB Ltd valued property and plant at £600,000 and took over the receivables subject to an allowance of 5%, set out LSB’s:

(i) Purchase of business account

(ii) The opening Statement of financial position.

Step by Step Answer:

Financial Accounting An Introduction

ISBN: 9780273737650

2nd Edition

Authors: Mr Barry Elliott, Mr Augustine Benedict