Epsilon Ltd is engaged in the manufacture and distribution of motor spares and accessories. These balances and

Question:

Epsilon Ltd is engaged in the manufacture and distribution of motor spares and accessories.

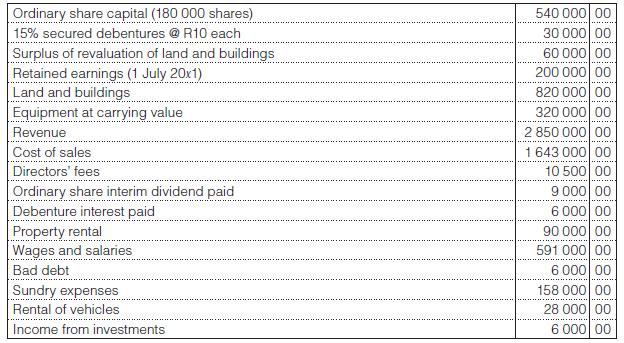

These balances and totals appeared in the pre-adjustment trial balance as at 30 June 20x2 (financial year end):

This information relates to the above balances:

• The debentures are redeemable in ten equal annual instalments of R10 000 on 31 March each year, the last instalment being payable on 31 March 20x5. Interest is paid halfyearly on 31 March and 30 September.

• The lands consist of a factory in Cape Town that was revalued on 1 September 20x1. Subsequent additions were recorded at cost.

• The net current assets include South African normal taxation of R22 000 over-provided during the last financial year. Also included are provisional tax payments for the current year of R132 000 and interest accrued on debentures (1 July 20x1) of R1 500.

• Equipment is depreciated at the rate of 10% per annum on the reducing balance method. There were no acquisitions or disposals of equipment during the current year.

• South African normal company taxation for the current financial year has been accurately calculated to be R132 875.

• Auditors will be paid a total of R24 000.

• A final dividend of 20c/share has been authorised and declared.

You are required to:

1. Prepare the statement of profit or loss & other comprehensive income and statement of changes in equity of Epsilon Ltd for the year ended 30 June 20x2 for the purpose of publication.

2. Prepare the note that would be attached to the item ‘land and buildings’ in the published statement of financial position of Epsilon Ltd on 30 June 20x2. (Comparative figures are not required.)

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit