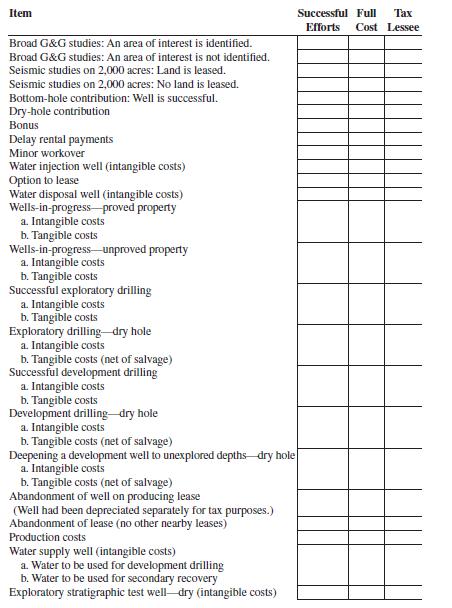

Question: Indicate which items are to be capitalized (C), expensed (E), or part capitalized and part expensed (C/E) for successful efforts, full cost, and tax accounting.

Indicate which items are to be capitalized (C), expensed (E), or part capitalized and part expensed (C/E) for successful efforts, full cost, and tax accounting.

Assume the maximum tax deductions are taken.

Item Broad G&G studies: An area of interest is identified. Broad G&G studies: An area of interest is not identified. Seismic studies on 2,000 acres: Land is leased. Seismic studies on 2,000 acres: No land is leased. Bottom-hole contribution: Well is successful. Dry-hole contribution Bonus Delay rental payments Minor workover Water injection well (intangible costs) Option to lease Water disposal well (intangible costs) Wells-in-progress-proved property a. Intangible costs b. Tangible costs Wells-in-progress-unproved property a. Intangible costs b. Tangible costs Successful exploratory drilling a. Intangible costs b. Tangible costs Exploratory drilling-dry hole a. Intangible costs b. Tangible costs (net of salvage) Successful development drilling a. Intangible costs b. Tangible costs Development drilling-dry hole a. Intangible costs b. Tangible costs (net of salvage) Deepening a development well to unexplored depths dry hole a. Intangible costs b. Tangible costs (net of salvage) Abandonment of well on producing lease (Well had been depreciated separately for tax purposes.) Abandonment of lease (no other nearby leases) Production costs Water supply well (intangible costs) a. Water to be used for development drilling b. Water to be used for secondary recovery Exploratory stratigraphic test well-dry (intangible costs) Tax Successful Full Efforts Cost Lessee

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts