On February 14, 2020, Isabelle Moretti, Aida Kam, and Channade Fenandoe start a partnership to operate a

Question:

On February 14, 2020, Isabelle Moretti, Aida Kam, and Channade Fenandoe start a partnership to operate a marketing consulting practice. They sign a partnership agreement to split profits in a 2:3:4 ratio for Isabelle, Aida, and Channade, respectively. The following are transactions for MKF Marketing:

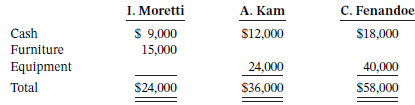

Feb. 14 The partners contribute assets to the partnership at the following agreed amounts:

They also agree that the partnership will assume responsibility for Channade?s accounts payable of $10,000.

Dec. 20 The partners agree to withdraw a total of $72,000 cash as a ?year-end bonus.? Each partner will receive a share proportionate to her profit-sharing ratio. No other withdrawals were made during the year.

31 Total profit for 2020 was $81,900.

2021

Jan. 5 The three partners agree to admit Carolyn Wells to the partnership. Carolyn will pay Channade $30,000 cash for 50% of her interest in the partnership. The profit-sharing ratio will be changed so that Carolyn is allocated 50% of what was previously allocated to Channade. The partnership?s name is changed to MKFW Marketing.

Dec. 20 The partners agree to pay another year-end bonus. The total amount withdrawn is $91,800. Each partner will receive a share proportionate to her profit sharing ratio. No other withdrawals were made during the year.

31 Total profit for 2021 was $103,050.2022

Jan. 2 Channade withdraws from the partnership. The partners agree the partnership will pay her $25,550 cash. The partnership?s name is changed to MKW Marketing.

Instructions

a. Record the above transactions. For the profi t recognized each year, calculate how it is to be allocated and close the accounts to the Income Summary account.

b. Prepare the statement of partners? equity for 2021.

c. Calculate the balance in each partner?s capital account on January 2, 2022, after Channade has withdrawn.

Taking It Further

Moretti, Kam, and Fenandoe discuss the liquidation of a partnership. Moretti argues that all cash should be distributed to partners based on their profit and loss ratios. Is he correct? Explain.

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak