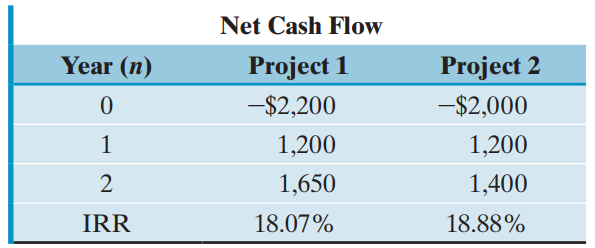

Consider the following two mutually exclusive investment projects: Determine the range of MARR where Project 2 would

Question:

Determine the range of MARR where Project 2 would be preferred over Project 1 with €œdo-nothing€ alternative.

(a) MARR ‰¤ 11.80%

(b) MARR ‰¥ 11.80%

(c) 11.80% ‰¤ MARR ‰¤ 18.88%

(d) MARR ‰¤ 18.88%

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Net Cash Flow Year (n) Project 2 -$2,000 Project 1 -$2,200 1,200 1,200 1,650 1,400 IRR 18.07% 18.88%

Step by Step Answer:

IRR 12 118 MARR and IRR 2 18...View the full answer

Related Video

The internal rate of return, or IRR, is a metric used to measure the profitability of an investment. It is the discount rate that makes the net present value of an investment equal to zero. To calculate the IRR, we need to know the investment\'s cash flows. These are the inflows and outflows of cash that will result from the investment. For example, an investment in a property might have cash outflows for the purchase price, closing costs, and any renovations, and cash inflows from rent and eventual sale of the property. The IRR is the discount rate at which the NPV of the investment is equal to zero. There are many ways to calculate IRR, from simple spreadsheet functions to more complex financial modeling software. It\'s worth noting that IRR can be a bit tricky when it comes to projects that don\'t have a consistent cash flow over time. These types of investments are known as \"irregular cash flow\" and the IRR might be misleading or not suitable to calculate. There are other metrics to evaluate these investments such as Modified Internal Rate of Return (MIRR) which is a variation of IRR and is used to get more accurate results.

Students also viewed these Business questions

-

Consider the following two mutually exclusive projects: Whichever project you choose, if any, you require a 15 percent return on your investment. (a) If you apply the payback criterion, which...

-

Consider the following two mutually exclusive projects available to Global Investments, Inc.: The appropriate discount rate for the projects is 10 percent. Global Investments chose to undertake...

-

Consider the following two mutually exclusive investment projects: Assume that MARR = 15%. Which project would be selected under an infinite planning horizon with project repeat ability likely,...

-

The preferred stock of Walter Industries Inc. currently sells for $36 a share and pays $2.50 in dividends annually. What is the firms cost of capital for the preferred stock?

-

Initially, a particle is moving at 4.10 m/s at an angle of 33.5 above the horizontal. Two seconds later, its velocity is 6.05 m/s at an angle of 59.0 below the horizontal. What was the particle's...

-

A series audio circuit is shown in Fig. 9.88. (a) What is the impedance of the circuit? (b) If the frequency were halved, what would be the impedance of the circuit? -20 j30 120 250 Hz -20

-

Using the same parameters as in Example 15.2. find the value of the 5-month call if the initial value of the stock is \(\$ 63\). Hence estimate the quantity \(\Delta=\triangle C / \Delta S\)....

-

As part of your audit of the Abba Company accounts payable function, your audit program includes a test of controls addressing the company policy requiring that all vouchers be properly approved. You...

-

Total debt-to-assets ratio, debt-to-equity ratio and Long-term debt-to-capital ratio are examples of what type or category of ratios?

-

In a pretest, data on Nike were obtained from 45 respondents. These data are given in the following table, which gives the usage, sex, awareness, attitude, preference, intention, and loyalty toward...

-

A manufacturing firm is considering the following mutually exclusive alternatives: Determine which project is a better choice at MARR = 15% on the basis of the IRR criterion. Net Cash Flow Project B...

-

With $10,000 available, you have two investment options. The first option is to buy a certificate of deposit from a bank at an interest rate of 10% annually for five years. The second choice is to...

-

A beam of particles of kinetic energy E = 10 MeV and intensity I = 1 A hits a lead target [A = 207, Z = 82, = 1.14 x 10 4 kg m -3 ] of thickness t = 0.2 mm. We locate a counter of area S = 1 cm 2...

-

What are five necessary conditions for project success. What are some project constraints that could affect project success?

-

What specific steps can a leader of a nonprofit initiate to engage their organization in the branding process?

-

List and define individual sources of resistance to change. Which ones apply to you? Why?

-

A 5.0 kg crate is on an incline that makes an angle of 30 with the horizontal. If the coefficient of static friction is 0.5, the maximum force that can be applied parallel to the plane without moving...

-

A shipping company moves cars from Texas to Maryland with the demand curve Q=5000-100P, and ships motorcycles back from Maryland to Texas with the demand curve Q=1000-100P. The cost of round trip is...

-

Compute AB by block multiplication, using the indicated partitioning. 2 3 2 B : 3 0 0 0 4 ||

-

Velshi Printers has contracts to complete weekly supplements required by fortysix customers. For the year 2018, manufacturing overhead cost estimates total $600,000 for an annual production capacity...

-

Using the three-component model for creativity, which area do you believe would be easiest for managers to affect? Why?

-

Describe the three key elements of motivation.

-

Describe one of the three early theories of motivation and evaluate its applicability today.

-

Martinez Company buys merchandise on account from Marigold Company for $592. Martinez sells the goods to Ellis for $900 cash. Use a tabular summary to record the transactions for Martinez Company...

-

The section has tension and compression steel reinforcement. When the neutral axis depth is at infinity, c = , the section is in uniform compression, all points on the section have 0.003 compressive...

-

The Big Choo Choo Company (BCCC) owns a rail line from the town of Isolated to the coastal port of Notso. It cost them $20 million to build the rail line in 2016. It is now 2023. The Small Gold...

Study smarter with the SolutionInn App