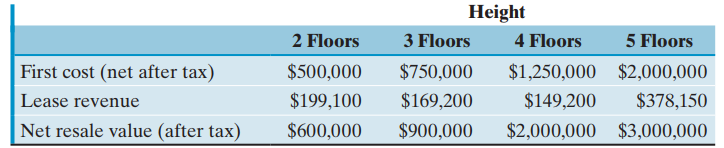

A real-estate developer seeks to determine the most economical height for a new office building. The building

Question:

(a) The developer is uncertain about the interest rate (i) to use but is certain that it is in the range of 5% to 20%. For each building height, find the range of values of i for which that building height is the most economical.

(a) The developer is uncertain about the interest rate (i) to use but is certain that it is in the range of 5% to 20%. For each building height, find the range of values of i for which that building height is the most economical.(b) Suppose that the developer€™s interest rate is known to be 15%. In terms of PW, what would be the cost of an error in overestimation of resale value such that the true value is 10% lower than the original estimate? Salvage Value

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: