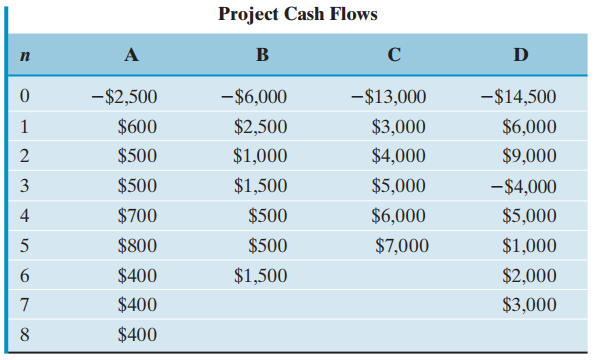

Consider the following cash flows, for four different projects: (a) Calculate the conventional payback period for each

Question:

(a) Calculate the conventional payback period for each project.

(b) Determine whether it is meaningful to calculate a payback period for Project D.

(c) Assuming i = 10% calculate the discounted-payback period for each project.

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: