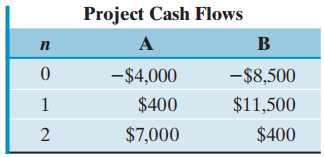

Consider the following two mutually exclusive investment projects: Assume that the MARR = 15%. (a) Using the

Question:

Assume that the MARR = 15%.

(a) Using the NPW criterion, which project would you select?

(b) On the same chart, sketch the PW(i) function for each alternative for i = 0% and 50%. For what range of i would you prefer Project B?

Transcribed Image Text:

Project Cash Flows A B п -$4,000 -$8,500 $11,500 $400 $400 $7,000 1.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 73% (15 reviews)

a Select project B b Project B dominates Project A at any int...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Consider the following two mutually exclusive investment projects that have unequal service lives: (a) What assumption(s) do you need in order to compare a set of mutually exclusive investments with...

-

Consider the following two mutually exclusive investment projects: Assume that MARR = 15%. Which project would be selected under an infinite planning horizon with project repeat ability likely,...

-

Consider the following two mutually exclusive investment projects: Determine the range of MARR where Project 2 would be preferred over Project 1 with do-nothing alternative. (a) MARR ¤ 11.80%...

-

Provide an detailed overview on the topic indirect pay/benefits. Use the information given: Indirect Pay: any type of employer-provided reward (or "benefit") that serves an employee need but is not...

-

What relative direction between a magnetic field and a current-carrying wire results in the greatest force?

-

For what number does the principal square root exceed eight times the number by the largest amount?

-

Water is flowing through a long pipe of diameter \(15 \mathrm{~cm}\) at \(300 \mathrm{~K}\). The pressure gradient is \(500 \mathrm{~Pa} / \mathrm{m}\). Using the Blasius equation for the friction...

-

The assembly department has the following production and cost data for the current month. Materials are entered at the beginning of the process. The ending work in process units are 70% complete as...

-

At June 30, Almond Co.'s cash balance was $10,012 before adjustments, while its ending bank statement balance was $10,772. Check number 101 was issued June 2 in the amount of $95, but was erroneously...

-

Mason Advertising was founded in January 2013. Presented below are adjusted and unadjusted trial balances as of December 31, 2020. Instructions a. Journalize the annual adjusting entries that were...

-

Consider the following two mutually exclusive projects: What value of X would make the decision maker indifferent between A and B at an interest rate of 12%? A B -$12,000 -$10,000 $X $4,000 $6,000...

-

Consider the following two mutually exclusive investment projects: Assume that the MARR = 12%. (a) Which alternative would you select by using the NPW criterion? (b) Which alternative would you...

-

Given the demand function and the supply function Find (a) the consumers surplus (b) the producers surplus assuming pure competition. P = -Q 4Qp + 68 P = Q + 2Qs + 12

-

3- Compare and contrast domestic and Eurocurrency money markets. 4- Discuss the systematic risk of a foreign project compared with a purely domestic investment. Explain how to estimate the...

-

Why is the venture evaluation matrix on its own not enough to make financial investment decisions?

-

Total sukuk issuance of 2,000 units at par value of RM1,000 each. The sukuk was sold at RM1,245 per bond, maturing in 20 years, annual coupon of 6%, and to be redeemed for RM1,000 upon maturity. ...

-

Explains why the investor would require more or less debt vs. equity financing.

-

In preparation for the interview, you must research the top 20 interview questions and prepare your personalized answers to each one. Accounting field

-

What is the ratio of the suns gravitational force on the moon to the earths gravitational force on the moon?

-

The area of a rectangle is 30 cm 2 and its perimeter is 26 cm. Find the length and width of the rectangle.

-

What are the principal e-commerce business and revenue models? a. Name and describe the principal e-commerce business models. b. Name and describe the e-commerce revenue models.

-

How has e-commerce transformed marketing? a. Explain how Internet technology supports business-to-business electronic commerce. b. Define and describe Net marketplaces and explain how they differ...

-

How has e-commerce affected business-to-business transactions? List and describe important types of m-commerce services and applications.

-

A teapot with a brewer at the top is used to brew tea, as shown in Fig. P3-143. The brewer may partially block the vapor from escaping, causing the pressure in the teapot to rise and an overflow from...

-

Search and locate a current international issue (an issue that affects more than one culture). 1. Describe the issue 2. Define and discuss the two or more cultures involved in the issue 3. Explain...

-

How is ethics defined in research and why is it important? Discuss two different ways in which ethics can be compromised when conducting, using, and reporting data. Describe strategies that can be...

Study smarter with the SolutionInn App