Fesel Company is making adjusting journal entries for the year ended December 31, 2017. In developing information

Question:

Fesel Company is making adjusting journal entries for the year ended December 31, 2017. In developing information for the adjusting journal entries, you learned the following:

a. A two-year insurance premium of $7,200 was paid on January 1, 2017, for coverage beginning on that date. As of December 31, 2017, the unadjusted balances were $7,200 for Prepaid Insurance and $0 for Insurance Expense.

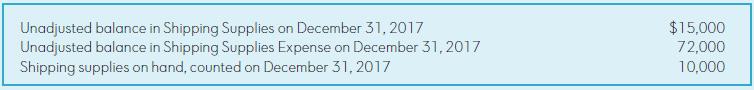

b. At December 31, 2017, you obtained the following data relating to shipping supplies:

Required:

1. Of the $7,200 paid for insurance, what amount should be reported on the 2017 income statement as Insurance Expense? What amount should be reported on the December 31, 2017, balance sheet as Prepaid Insurance?

2. What amount should be reported on the 2017 income statement as Shipping Supplies Expense? What amount should be reported on the December 31, 2017, balance sheet as Shipping Supplies?

3. Using the format shown in the demonstration case, indicate the accounting equation effects of the adjustment required for transaction (a) dealing with insurance and transaction (b) dealing with shipping supplies.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Fundamentals of Financial Accounting

ISBN: 978-1259269868

5th Canadian edition

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh